What Is a Car Lease? Key Takeaways

- Leasing a car lets you drive it for a fixed period, typically between two and four years, without buying it

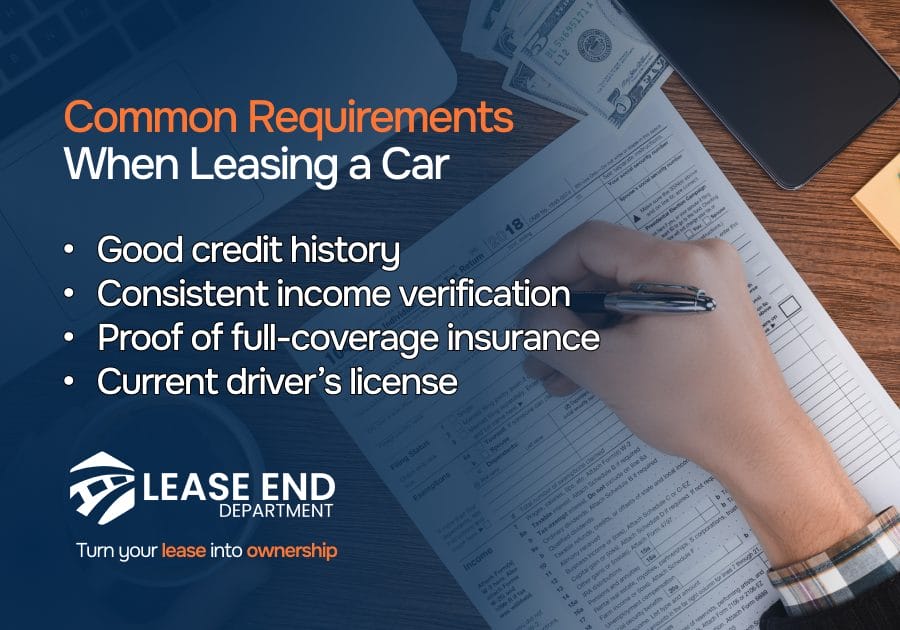

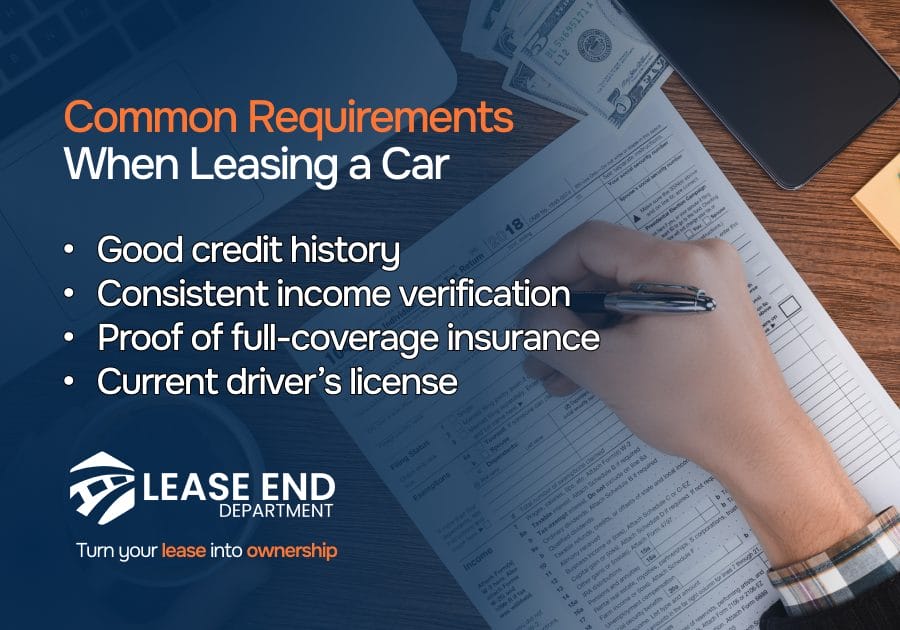

- You’ll need a valid driver’s license, a strong credit score, proof of steady income, and active auto insurance to lease a car

- Buying out your lease could cost less than the car’s market value

From 2017 to 2025, more than one in five new vehicles in the United States were leased, reflecting a growing trend among drivers looking for flexibility.

Leasing a car is a popular choice for those who want lower monthly payments and access to newer models.

In this guide, we will:

- Break down what a car lease is and how the process works

- Outline the key requirements for leasing a vehicle

- Answer common questions people have about car leasing

What Is a Car Lease?

Leasing a car means driving it for a fixed period, typically two to four years, without owning it.

Instead of making a down payment and financing the full cost, you pay monthly installments for the duration of the lease.

When the lease ends, you simply return the car to the leasing company.

What Is Needed To Lease a Car?

Requirements can vary slightly by lender, but most leasing companies look for the following before approving your application:

1. A Strong Credit Score

Most lease approvals go to drivers with good to excellent credit, typically with a score of at least 700 or higher.

A strong credit profile can help you qualify for better terms and lower monthly payments.

If your score falls below 700, you can still qualify, but you’ll likely face a higher down payment or increased interest rate.

2. Proof of Steady Income

Lenders want to see that you have a reliable source of income to cover your monthly payments.

Requirements vary, but you’ll usually need to provide:

- Recent pay stubs

- Bank statements

- Credit card statements

- Tax returns

3. A Valid Auto Insurance

Leasing companies require you to show proof of insurance, usually full coverage, before you drive off the lot to protect their investment during the lease.

If your policy lapses, the leasing company can purchase coverage on your behalf, often at a much higher cost, and pass the bill on to you.

4. A Valid Driver’s License

A current and valid driver’s license is mandatory for any lease agreement.

Make sure your license details are up to date and match the information on your lease application to avoid delays.

How To Lease a Car in 5 Steps

Leasing a car can be a smart financial move, especially if you want lower monthly payments and access to newer models.

But getting the best deal means understanding the process and avoiding common pitfalls.

Here are the steps to leasing a car:

Step 1: Ask Yourself Some Questions

Before you sign anything, make sure leasing aligns with your lifestyle and driving habits.

Reflect on the questions below:

- Do you prefer driving a newer car every few years?

- Are you comfortable returning the vehicle at the end of the term?

- How many miles do you drive each year, and will you stay within that mileage limit?

Quick note: Most leases include 10,000 to 15,000 miles per year. Higher-mileage options, like up to 30,000 miles, are available but come at a higher cost.

Step 2: Know Your Credit Score

Lenders look at your credit to determine if you’re likely to make payments on time.

With a strong score of 700, you’re more likely to secure favorable terms, like lower monthly payments and less money due at signing.

Tip: Boosting your score before applying can pay off with better lease offers.

Step 3: Research Lenders and Set a Realistic Budget

Before locking in a lease, take time to compare lenders.

Look for leasing companies that:

- Offer fair monthly payments based on the vehicle’s price

- Provide your expected capitalized cost reduction (often influenced by your down payment or trade-in value)

- Clearly explain fees, mileage limits, and end-of-lease terms upfront so there are no surprises later

Putting more money down upfront can lower your monthly payment, which can help you stay within your budget.

Step 4: Negotiate Terms

Once you’ve found a car that fits your needs, it’s time to negotiate the lease terms, just like you would if you were buying.

Focus on these key areas:

- Try to lower the starting price of the car, just like you would when buying

- If you expect to drive more than average, ask for a higher mileage cap upfront to prevent costly overage fees

- Inquire about reducing or waiving common charges like acquisition, disposition, and documentation fees

Step 5: Carefully Review and Finalize Your Lease

Before putting pen to paper, take a close look at the lease agreement to ensure everything aligns with what was discussed.

Pay special attention to:

- Monthly payment and upfront costs: Confirm your total monthly payment and any amount due at signing.

- Mileage allowance: Know your annual mileage limit and the cost per mile if you go over.

- End-of-lease terms: Check for early termination fees and other return conditions.

- Buyout option: See if the lease includes a purchase option and how the lease buyout amount is calculated.

Once everything looks accurate and you’re comfortable with the terms, go ahead and sign.

Keep a copy of the signed agreement for your records.

How Long Does a Car Lease Last?

Most car leases range from two to five years, with the average term falling between 24 and 36 months.

The length of your lease can impact both your monthly payment and how many miles you’re allowed to drive each year.

In general, longer leases tend to come with lower monthly costs.

Why Lease a Car? Here Are 3 Reasons

For many drivers, leasing provides flexibility and cost savings.

Here’s why it might work for you:

1. Lower Maintenance Costs

Did you know the average cost of owning a car in the U.S., including maintenance, was $6,684 in 2024?

One reason many people choose to lease instead is that most leased vehicles remain under factory warranty throughout the lease term.

This often means that routine maintenance and repairs are covered, helping reduce out-of-pocket expenses.

Just keep in mind that while normal wear is expected, any excessive damage may result in additional charges at the end of the lease.

2. Ideal for Short-Term Situations

Leasing can be a practical option if you’re living in a city temporarily, for example, during a job assignment, internship, or while attending college.

It gives you access to a reliable vehicle without the long-term commitment or upfront costs of buying.

When the lease ends, you can simply return the car, avoiding the hassle of selling or dealing with depreciation.

3. Drive Newer Cars More Often

Lease terms usually run shorter than traditional car loans, often just two to four years, meaning you can upgrade to a newer model more often, without locking yourself into a long-term financial commitment.

And since you’re driving newer vehicles, leasing also gives you access to the latest safety features, better fuel economy, and the newest in-car technology.

Think of it as a smart way to enjoy premium features at a lower monthly cost than buying.

Is Car Leasing Right for You?

It depends on your lifestyle, driving habits, and financial goals.

Leasing can be a smart option if you prefer lower monthly payments, like driving newer cars every few years, and don’t mind mileage limits or not owning the vehicle.

Leasing could be a good fit if you:

- Drive fewer than 15,000 miles per year

- Want predictable maintenance costs

- Prefer a short-term commitment with the option to upgrade

- Don’t plan to customize or heavily use the vehicle

But if you drive long distances, want to build equity, or prefer long-term value, buying might be the better route.

What Happens at the End of Leasing a Car?

When your lease ends, you usually have three choices: return the car, buy it, or extend the lease.

Here’s what each option looks like:

1. Return the Vehicle

You return the car to the leasing company and walk away, if everything checks out during the return process:

- The car will go through a final inspection for wear, damage, and mileage overages

- You may be charged for anything outside of normal wear or if you’ve exceeded your mileage limit

- Once the paperwork is finalized, your lease responsibilities end

Returning is a good choice if you don’t want to keep the car and you’re ready to lease another car.

2. Buy the Car (Lease Buyout)

If you’ve grown attached to your car (or it’s worth more than the buyout price), you can purchase it.

Here’s what to do if you’re thinking about buying out your lease:

- You’ll pay the residual value listed in your lease contract

- Before committing, compare that amount to the car’s current market value. If the lease buyout price is too high, it might not be worth it

- Some drivers choose this route to avoid mileage penalties or to keep a car they already know and trust

3. Extend Your Lease

Thinking about keeping the car a little longer?

Here’s what the lease extension process usually looks like:

- Contact your leasing company to see if extension terms are available

- You’ll sign a new agreement and continue making monthly payments

- This can be helpful if you’re waiting for a new vehicle or just want to delay your next move

How Lease End Department Helps You Buy Out Your Lease

Thinking about keeping your leased car?

Whether your lease is ending soon or you want to buy it out early, Lease End Department makes the process simple and stress-free.

Here’s how we support you every step of the way:

- Understand your options: We walk you through your lease agreement, helping you decide if a buyout, lease transfer, or trade-in makes the most sense based on your goals and finances.

- Explore tailored financing: Whether you’re keeping your current vehicle or transitioning into something new, we help you find loan options that fit your credit profile and monthly budget.

- Skip the dealer games: We handle the paperwork in-house, so you avoid dealership markups, hidden fees, and inflated buyout quotes.

- Let us handle the DMV: From title transfer to plate delivery, we manage all the registration details, saving you time, hassle, and trips to the DMV.

What Is a Car Lease? FAQs

Can I lease a car with bad credit?

Yes, but it might be more challenging. Lower credit scores can lead to higher upfront costs and less favorable lease terms.

Is a lease buyout worth it?

Yes. If the market value of your vehicle is higher than the buyout price, purchasing it can save you money and let you skip return fees and inspections.

Are lease payments negotiable?

Absolutely. You can negotiate the car’s selling price (capitalized cost), mileage limits, and some fees.

Don’t forget to question fees like the acquisition, disposition, and documentation charges, as some dealers are willing to waive or reduce them.

Always compare offers from multiple lenders to make sure you get the best overall deal.

What’s the biggest downside when leasing a car?

The biggest drawback is that you don’t build any ownership or equity. Your monthly payments go toward using the car, not owning it.

At the end of the lease, you return the vehicle or pay a lump sum to buy it.

Unlike financing, where your payments eventually lead to full ownership, leasing leaves you with no assets to sell or trade in.

This can be costly in the long term, especially if you lease repeatedly without ever transitioning to ownership.

Can you sell a leased car?

Yes, but it depends on your lease terms and timing.

Most leases include a buyout clause that lets you purchase the car at a set residual value.

Once you own it, you’re free to sell it to a dealer, private buyer, or online.

Can you lease a used car in 2025?

Yes, but it’s less common than leasing new. Most used car leases are limited to certified pre-owned (CPO) vehicles or lease takeovers from other drivers.

While leasing a used car can mean lower monthly payments and reduced depreciation, it often comes with stricter terms, limited availability, and fewer warranty protections.

What is a closed-end lease?

A closed-end lease, or a “walk-away lease,” lets you return the car at the end of the term with no obligation to buy it or pay for its remaining value.