What to Know When Leasing a Used Car

- Leasing a used car can mean lower monthly payments and less depreciation, but it often comes with limited availability, stricter lease terms, and fewer warranty protections

- Used car leasing is possible but typically limited to certified pre-owned (CPO) vehicles or lease takeovers from other drivers

- Monthly payments are usually lower than leasing new, but dealer participation is limited, and warranties may vary

- Lease takeovers can be a fast, flexible way to lease a used car without starting a full-term lease

- Buying out your current lease can be a better long-term value, especially if the buyout price is lower than current market value

Your lease is ending soon, and you’re only seeing rising prices for new cars.

You don’t want another full loan commitment, but you also don’t want to give up driving a reliable, well-equipped vehicle.

So, you wonder, can you lease a used car instead?

While less common than new leases, used car leasing is something you should definitely consider.

In this guide, you’ll learn:

- How used car leasing works and what types of vehicles qualify

- The pros and cons of leasing used vs. new

- Where to find the best used car lease deals

- Whether alternatives like lease buyouts are a smarter move

Can You Lease a Used Car?

Yes, you can lease a used car, but the process isn’t as common or straightforward as leasing a new one.

Most used car leases are offered by dealerships through certified pre-owned (CPO) programs or via lease takeovers, where you assume someone else’s lease mid-term.

Here’s what to know upfront:

- Used leases are typically limited to CPO vehicles that are only a few years old and have passed strict inspections

- Not all lenders or dealers offer used car leases, and those that do may charge higher money factors (interest rates)

- Lease takeovers can be a shortcut to a used lease but often come with shorter remaining terms and less flexibility

Used car leases may not include the same incentives, warranty coverage, or mileage flexibility as new leases. However, they can still be a smart option for drivers who want to lower monthly payments or test a specific model without committing to a purchase.

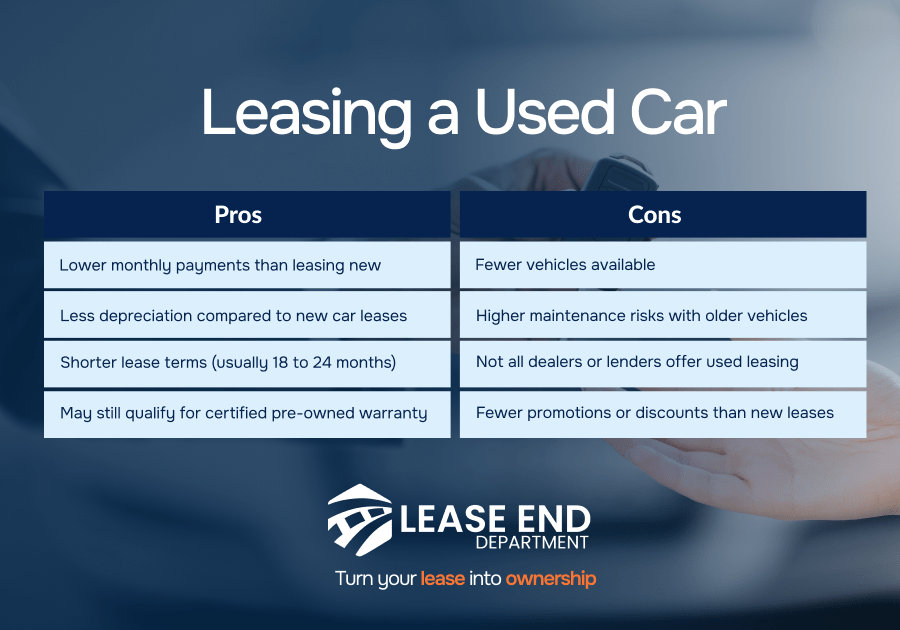

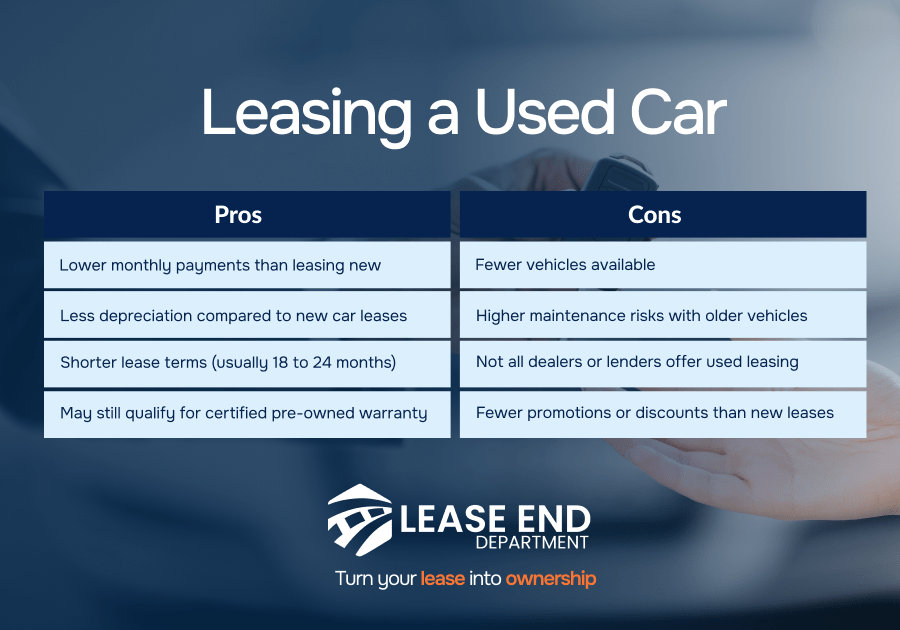

Pros and Cons of Leasing a Used Car

Leasing a used car can be a budget-friendly way to drive a well-equipped, late-model vehicle, but it’s not the right fit for everyone.

Should You Lease, Buy, or Lease-To-Own?

Not sure if a used car lease is the right fit for your goals?

Use this quick breakdown to decide:

- Choose buying over leasing if you want long-term value, full ownership, and no mileage restrictions.

- Choose leasing if you want lower monthly payments, newer vehicles, and short-term flexibility

- Choose lease-to-own if you want low upfront costs with the ability to keep the car at the end.

Where To Find the Best Used Car Lease Deals

Used car leases can be harder to find than new ones, but there are still smart places to look.

These are the most reliable options for securing a quality used lease deal.

Certified Pre-Owned Programs at Dealerships

Many automakers offer lease options on CPO vehicles that meet specific age and mileage requirements.

Some of these programs include:

- BMW CPO Lease Program: Offers leases on select 1–4 year-old models with extended warranty and roadside assistance.

- Lexus CPO Leasing: Available through Lexus Financial Services, typically on vehicles under 6 years old and 70,000 miles.

- Mercedes-Benz Star Certified Program: Includes lease options with 12-month unlimited mileage warranty.

Ask your local franchise dealership what CPO leasing options they have available for late-model cars.

Online Lease Takeover Marketplaces

These platforms let you assume someone else’s lease, which is often more flexible and affordable than starting a new one.

Best platforms for these leases include:

- Swapalease: Nationwide listings where drivers transfer remaining lease terms. Many include incentives like no down payment or cash back from the seller.

- LeaseTrader: Offers detailed filters for mileage, term length, and monthly cost to help you find a lease that fits your needs.

These online platforms are a good option if you want a short-term lease with minimal upfront costs.

Lease Return Vehicles at Local Dealerships

Dealers regularly take back lease return vehicles that are in good condition and may offer them as CPO or even informal used leases.

Potential return vehicle examples might include:

- A 2021 Toyota Camry returned from lease and re-listed as a certified used lease.

- A returned 2020 Audi A4 with low mileage, offered with a short 24-month lease and included maintenance.

- Visit or call dealerships and ask if they have “off-lease” vehicles available for used leasing or flexible financing.

How To Compare Offers

Whether you’re looking at a CPO lease or a lease takeover, it’s important to go beyond just the monthly payment.

Evaluate the full deal using these key factors:

- Money factor: This is the interest rate expressed as a decimal (lower is better)

- Residual value: The estimated value of the car at the end of the lease (higher is better)

- Mileage allowance: Standard is 10,000–15,000 miles per year

- Fees: Watch for acquisition, disposition, and early termination fees

- Warranty coverage: Check if CPO or lease transfer includes repairs or roadside assistance

Better Alternatives To Leasing a Used Car

While leasing a used car can offer short-term savings, it’s not always the most flexible or cost-effective option.

Depending on your situation, there may be better ways to get behind the wheel of a reliable vehicle without overpaying or sacrificing long-term value.

Buy Out Your Current Lease

If you’re already leasing a vehicle and nearing the end of your term, consider buying it out. You already know the car’s history, and the residual value (buyout price) may be lower than the current market price, especially with today’s rising used car costs.

This is good because:

- It’s a smart move if you like your current car and want to avoid starting a new lease.

- You can start your lease buyout process earlier

Explore Lease-To-Own or Early Buyout Options

Some drivers choose to end their lease early through a buyout or shift into a lease-to-own model.

This could be good for you if:

- You want to stop leasing and start building equity

- You’re facing rising lease payments or dealer pressure

- You prefer keeping the car you’ve already been driving

Can You Lease a Used Car: Key Takeaways

- Leasing a used car can offer short-term savings but comes with fewer choices and limited dealer availability.

- Certified pre-owned leases are the most common path, especially with luxury brands like BMW and Lexus.

- Lease takeovers are another option, often with lower costs and shorter remaining terms.

- For many drivers, buying out an existing lease offers more control, fewer fees, and better long-term value.

How Lease End Department Helps You Take the Next Step

If you’re weighing your options between leasing a used car, buying your current lease, or switching vehicles altogether, Lease End Department is here to help.

We specialize in making the lease-end process easy and stress-free, whether you want to keep your current car or move on to something new.

Our team will:

- Review your current lease or car details

- Help you explore flexible buyout or financing options

- Prepare all documents for you to sign securely

- Handle title, registration, and even plate delivery

You don’t need to go back to the dealership or figure it out alone. We’ve already helped thousands of drivers buy out their leases and keep the cars they know and love.

Want to get started? Get pre-approved or check your estimated payment with our payment calculator.