Lease Buyout Loans: Smart Tips To Own Your Leased Car

Lease Buyout Loans: Key Takeaways

- Using a lease buyout loan, you can pay your leased car’s residual value and transfer its ownership to you

- This can be a smart move if the car is in good condition or its market value exceeds the buyout price

- Disregard the buyout loan idea if the car needs repairs or you want more flexibility with car choices

- To get better terms on your loan condition, improve your credit, compare lenders, and consider a co-signer

More than 20% of new cars in the United States are leased, meaning millions of drivers at some point, face an important decision: return the car, sign a new lease agreement, or buy out the car they already use.

We’ll break down:

- When to consider a car lease buyout loan

- How to apply for it and secure financing

- Tips to get better loan terms

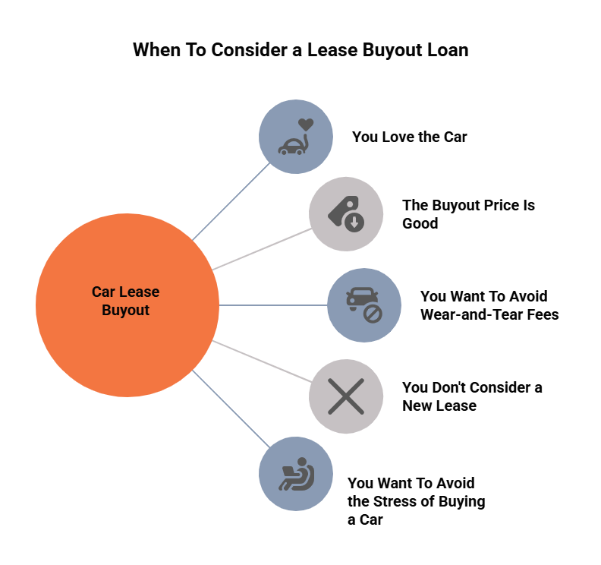

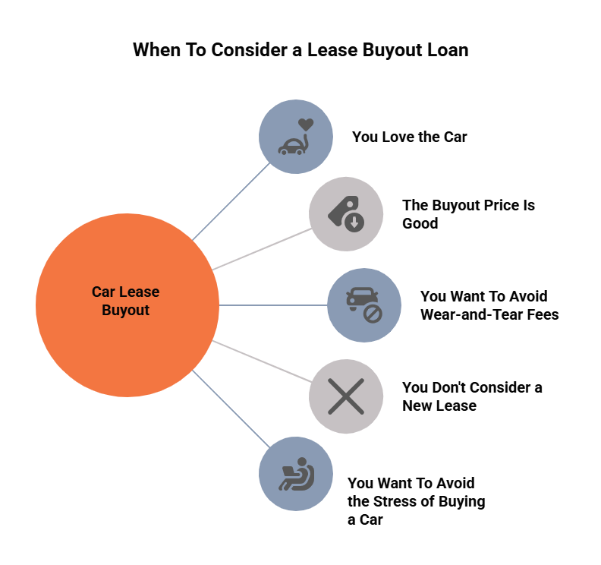

When Is a Car Lease Buyout Loan a Good Option?

Are you wondering which will be smarter: return your leased car or keep it?

Let’s look at real-world scenarios where buying your leased car might make sense.

You Love the Car and Know Its History

If your leased car runs well and you’ve taken good care of it over the years, buying it can be a smart move.

You’ll know all the maintenance it’s been through and the issues you’ve faced, information that you’ll not have if you buy a car from a stranger.

The Buyout Price Is Less Than the Market Value

Getting ownership of the car might be a good deal if the remaining value of the car, also known as residual price, is lower than what it’s worth at the moment.

This could be a plus if you decide to resell the car. For example, if your buyout price is $18,000 and the car is worth $21,000, you can make a profit of $3,000.

You Want To Avoid Mileage or Wear-and-Tear Fees

Leases often include charges for driving too many miles or having damage beyond “normal wear and tear.”

Buying the car means you won’t pay those penalties as you’ll keep the car.

You Can’t or Don’t Want To Lease Again

A lease buyout loan may be a good choice if your credit history isn’t great or there are currently not attractive lease deals. This will eliminate the risk of higher costs or denial of your application.

You Want To Avoid the Stress of Shopping for Another Car

Finding a new vehicle can be time-consuming and effort-consuming, especially if:

- Inventory is low.

- Prices are high.

Keeping the car you already have lets you skip the hassle and spend the time on your hobby.

Auto Lease Buyout Loan Explained

A lease buyout loan is a financial solution that allows you to buy the car you’re currently leasing.

An alternative to returning the car to the dealership or leasing company at the end of the lease period, a buyout loan allows you to pay off the remaining value of the car.

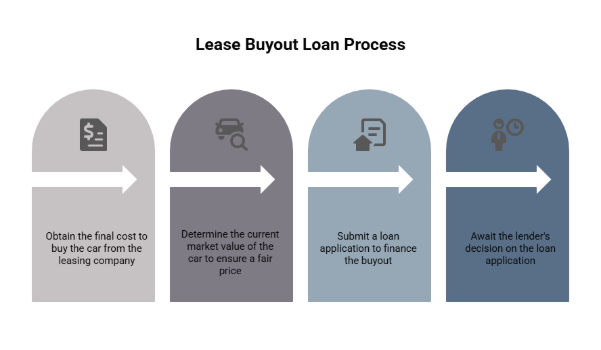

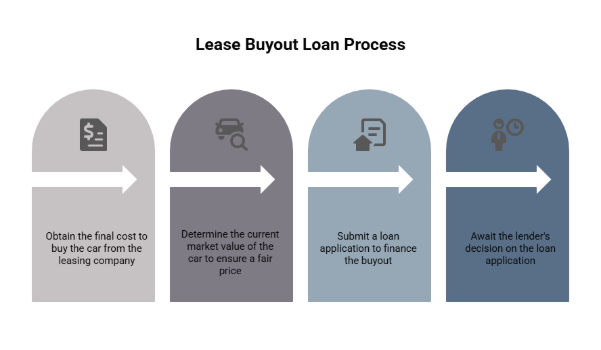

How the Buyout Loan Process Works

The process of buying your leased car includes several steps:

- Get a Payoff Quote From the Leasing Company

Call your leasing company and ask for a buyout quote. This will give you information about the amount you must pay, plus any extras like taxes or early return fees.

Check the validity of the quote to verify you have enough time to arrange a buyout loan.

- Check the Car’s Current Market Value

Research the market value of your car. Tools you can use include:

- Kelley Blue Book (KBB)

Compare the payoff price you’ve got to the market value of cars of the same make, model, year, mileage, and condition.

- Apply for a Lease Buyout Loan

If you don’t have enough money to pay the residual value, apply for a lease buyout loan through:

- Your bank

- Your credit union

- Online lenders specializing in auto loans

- The leasing company or dealership (if they offer financing options)

Documents you’ll need for applying include:

- Personal identification

- Proof of income, such as pay stubs and tax returns

- Credit information

- Wait for a Decision on Your Loan Application

If approved, the lender will pay the leasing company the payoff amount directly, and the leasing company will no longer be the car’s owner.

- Read the loan agreement line by line to understand the interest rate, monthly dues, any hidden fees, and what you’ll end up paying in the end.

- Sign the loan documents.

What Happens After You’ve Paid the Residual Value?

Once the lender has paid the residual value, you must:

- Register the car in your name, which requires paying registration fees and sales tax and providing proof of insurance.

- Making monthly payments until you pay the loan off and the car becomes yours.

Reasons To Avoid a Lease Buyout

While buying out your lease can be a good idea under certain circumstances, it also comes with certain drawbacks.

The Buyout Price Is Higher Than the Market Value

If the residual value is higher than what you can get for the car, you could end up paying more than if you bought a similar used car.

The Car Has Excessive Wear and Tear

If your leased car has mechanical damage, it might not be worth buying it as maintenance and repair costs can pile up, boosting the final cost up.

You Prefer To Be Flexible When Choosing a Vehicle

Buying your leased car typically means driving it for the next few years. If you like changing cars frequently, a new lease may be a better option.

Get Approved for a Lease Buyout Loan With Better Terms

Want the best deal? Follow these smart moves to make your buyout loan work in your favor.

Boost Your Credit Score

A good credit score, typically above 700, can qualify you for lower rates. To improve it, pay down debts, make on-time payments, and avoid applying for new credit while your lease buyout loan application is pending.

Compare Lenders

Collect multiple quotes from banks, credit unions, and online lenders, and check which of them offers the best conditions.

Consider a Co-Signer

Your chances of getting approved increase if you have a co-signer with a good credit history. This can also help qualify for a lower interest rate.

Need Help With Your Lease Buyout Loan? Call Lease End Department

Lease End Department helps drivers get ownership over their leased vehicles, taking the stress and paperwork off their shoulders.

If you’re feeling overwhelmed with the process, our team can:

- Provide an instant buyout quote, along with financing options and exclusive lender rates.

- Handle paperwork completion and filing.

- Process title and registration for you.

Starting the process with Lease End Department takes 8-10 minutes only. Everything is done online or over the phone without the need to go to the dealership or meet the leasing company staff.

Lease Buyout Loans: FAQs

What is the interest rate on a lease buyout loan?

Interest rates vary, but typically you’ll pay between 5% and 9%.

Can I buy out my lease early?

While buying out your lease early is possible, check for early termination fees that can increase the final amount.

Is a lease buyout better than a loan for buying a new car?

A lease buyout may be a good option if your leased car is in good shape and the buyout price is low.

Can I get a lease buyout loan with bad credit?

It’s possible, but your interest rate may be higher, and you might need a co-signer or larger down payment. Explore multiple options to find the best solution for your situation.