Toyota Lease Buyout: Key Takeaways

- When you signed your lease, Toyota set a future purchase price for the car. That number is called the residual value, and it was locked in on day one, so you’ll know exactly what it costs if you decide to buy it now

- Don’t forget the extras. On top of the buyout price, you’ll likely see sales tax, DMV registration, and maybe a documentation fee, depending on your state

- Usually, turning in a lease comes with a parting gift you don’t want, the $350–$500 disposition fee. The good news? If you buy your Toyota, that bill never shows up

- Don’t want to pay all at once? Many drivers spread the cost with a buyout loan, usually 2 to 5 years in length, with rates that rise or fall depending on your credit score

- You don’t have to go through the dealership. Lease End Department handles the entire process online, including the title transfer, financing, and even plate delivery

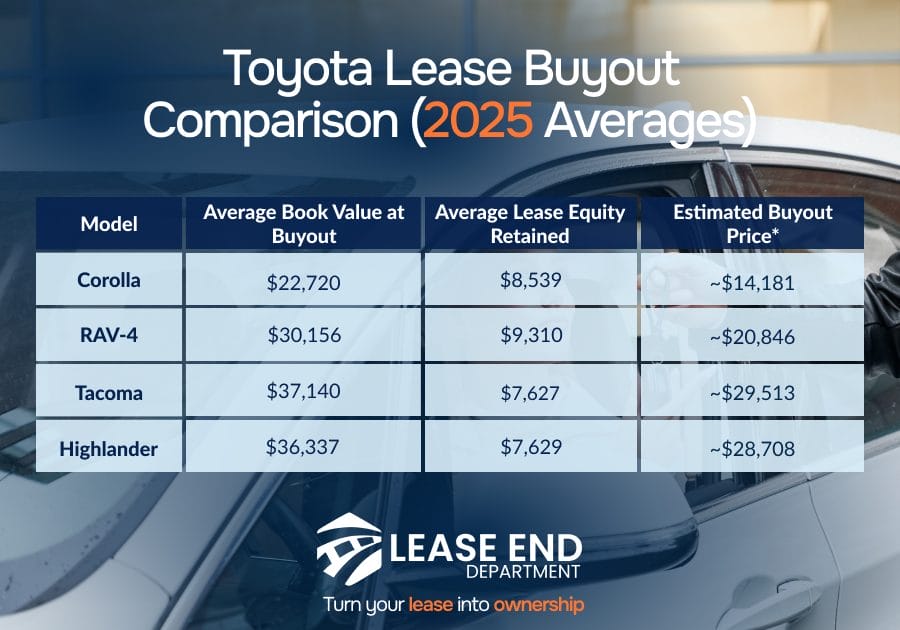

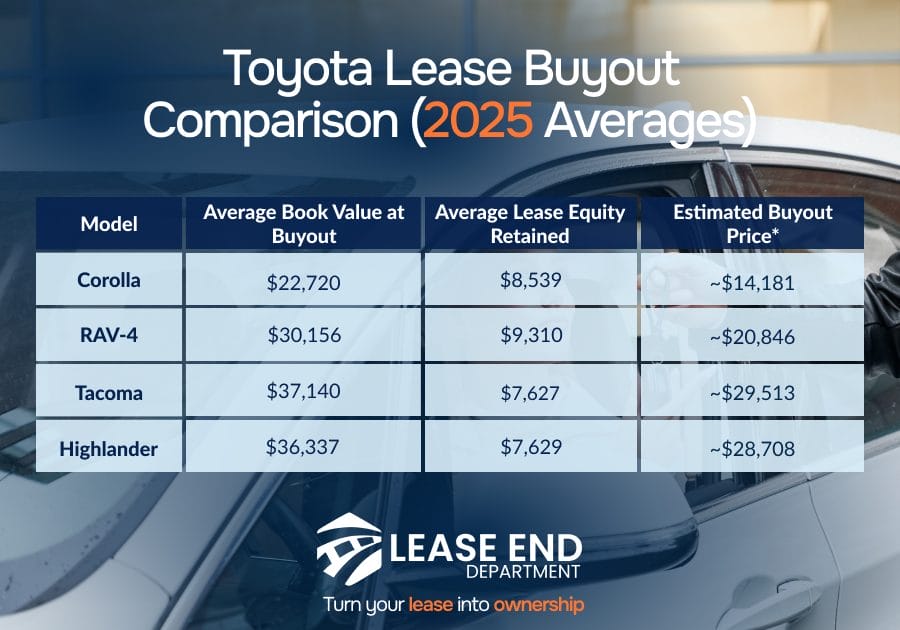

Toyotas are known for holding their value, and in 2025’s used car market, that makes a lease buyout more appealing than ever.

Maybe you love your current ride. Maybe you’ve racked up more miles than expected.

Or maybe you just want to skip dealership games and keep the car you already trust.

Whether you’ve fallen in love with your Toyota or simply want to dodge dealership games, knowing the numbers behind a lease buyout helps you make a decision with confidence, not guesswork.

In this article, you’ll learn:

- What your Toyota lease buyout price actually includes (and why it’s locked in from the start)

- The fees and taxes you should expect when buying your car

- How financing a lease buyout works and what rates look like in 2025

- The three choices at lease-end: return, buy, or upgrade

Toyota Lease End Options

When your Toyota car lease is almost up, you have usually three lease buyout options: keep the car, return it, or explore another path.

Here are your three main options, each with its pros and trade-offs:

1. Return the Vehicle

Not ready to commit? Returning your Toyota at lease-end is the simplest way to move on.

- Turn the car back in at your lease-end date and walk away, just make sure it’s within mileage limits and in good condition

- Expect possible fees like a $350–$500 disposition fee or charges for excess wear-and-tear

- Good choice if you’re ready for a new model or no longer need the car

2. Buy Out Your Lease

Thinking about keeping your Toyota? If you’ve taken good care of it or it’s worth more than the buyout price, this option could be a win.

- Pay the residual value (plus taxes and fees) listed in your lease contract to keep the vehicle

- This option can be smart if your car’s market value is higher than the buyout price, or if you simply love your Toyota and want to avoid the hassle of shopping again

Bonus: No disposition fee and no penalties for extra miles or minor damage.

3. Lease or Buy a New Toyota

Want to stay in the Toyota family? Upgrading to a newer model might come with extra perks.

- If you’re loyal to the brand, Toyota may offer loyalty incentives or promotions for starting a new lease or purchase

- Be sure to weigh costs carefully, including new down payments and higher monthly payments due to current market rates

How the Toyota Car Lease Buyout Works

If you’re thinking about buying your Toyota at the end of your lease, the process might be easier than you think. It all comes down to knowing your numbers, your options, and what steps to take next.

Let’s walk through what the process looks like when you’re ready to make that move.

Step 1: Review Your Lease Terms

Start by looking at your original lease contract; it holds most of the answers you’ll need.

Here’s what to focus on:

- Residual value: This is the price Toyota Financial Services set for your vehicle at lease-end, and it’s usually non-negotiable

- Early buyout clauses: If you’re thinking about buying before your lease is up, check for any fees or restrictions

- Mileage or wear considerations: A buyout can help you skip excess mileage or wear-and-tear charges altogether

Drivers on lease forums note that if you buy out early, you won’t owe the “rent” portion of future payments, just the payoff balance.

Step 2: Get Your Payoff Quote

Once you know where you stand, it’s time to get the actual number.

Your official buyout quote includes more than just the residual:

- Buyout amount: This is the residual plus any outstanding lease payments (if buying early)

- Sales tax: This varies by state, but usually gets added to the total

- Fees: You might see documentation or DMV fees depending on where you live

Step 3: Decide How You’ll Pay

Now you’ll need to choose between paying outright or financing the buyout.

Here’s what to weigh:

- Full payment: If you’ve got the cash, this is the cleanest path to ownership, no interest or extra paperwork

- Finance the buyout: Most drivers choose this route, spreading payments over 24 to 60 months

- Lease End Department can help: We handle financing, compare lender options, and even manage the title and registration for you

Toyota Lease Buyout Fees and Rates

Buying out your leased Toyota sounds simple, but there are a few costs that can sneak up on you if you’re not prepared. From taxes to potential dealer fees, knowing the breakdown upfront can save you both money and stress.

Let’s look at what goes into the total cost of a Toyota lease buyout:

1. Standard Buyout Costs

These are the fees nearly every lessee will encounter during a lease-end purchase:

- Residual value: This is the set price for your car at the end of your lease, listed in your original contract

- Sales tax: Typically based on the buyout amount, calculated at your local rate (can range from 6% to 10%+ depending on your state)

- DMV/title fees: Usually $150–$400, depending on your state and whether you need new plates or registration updates

2. Possible Additional Charges

In some cases, especially if you go through a dealership, you might run into extra costs:

- Documentation or dealer fees: These can range from $300 to $900, depending on your location and the dealer’s policy

- Processing fees: Some Toyota dealers charge admin fees even if you’re handling the buyout independently

- Early buyout fees: If you’re buying before your lease ends, double-check for early termination penalties

3. Financing Rates for a Toyota Lease Buyout

If you’re financing the buyout (like most drivers do), your rate will depend on your credit, lender, and term:

- Average rates: Expect between 5.9% and 9.5% for lease-end buyout loans in 2025

- Loan terms: Typically range from 24 to 60 months

- Tip: Pre-qualifying with Lease End Department can help you avoid dealership markups and access more competitive lender options

Toyota Lease Buyout Paperwork

Let’s be honest, no one gets excited about paperwork. But if you’re buying out your leased Toyota, having the right documents ready can make the process surprisingly smooth.

Here’s your no-fluff checklist:

- Lease agreement: This is the original contract you signed. It holds the key to your residual value, buyout terms, and any early payoff rules

- Payoff quote from Toyota Financial Services: Request this directly from your online portal or call Toyota Financial. It includes your residual value, remaining payments (if any), sales tax, and fees

- Odometer statement: Toyota often requires an odometer disclosure to document your mileage at buyout, especially if you’re nearing your mileage cap

- Valid driver’s license and proof of insurance: These confirm your eligibility and help speed up registration after the buyout

- Loan approval (if financing): Pre-approved? Great, bring your offer letter and lender details. Lease End Department clients can do all of this online

- State DMV title & registration forms: Depending on your state, you’ll either complete this through Toyota or independently. Make sure to factor in any plate transfer or tax requirements

Pro tip: Double-check that your name and address match across all documents; it’s a small detail that can cause big delays if overlooked.

Should You Buy or Return Your Toyota?

It’s decision time, and the right move depends on what drives you.

If you love your Toyota, know its full history, and want to skip dealership headaches, buying it out might be the smartest, simplest next step.

But if you’re ready for something new, returning it could open the door to your next upgrade.

Here’s what to weigh before making the call:

- Equity matters. If your Toyota’s market value is higher than the buyout price, you’re in a good spot to save or even profit by purchasing it

- Monthly payments shift. Lease payments are usually lower, but a buyout loan builds ownership and could pay off long-term

- Lifestyle counts. Planning to drive more? Want full ownership? Lean toward buying. Prefer flexibility? Returning might be right for you

Some Toyota owners have sold their leased cars to companies like CarMax, Carvana, or AutoNation and pocketed thousands in equity when the car’s market value exceeded the buyout price.

How Lease End Department Can Help

Why Lease End Department? Because we’re here to make your Toyota lease buyout feel less like paperwork and more like peace of mind.

Here’s how we do it:

- One-on-one guidance: We explain your residual value, DMV costs, and financing choices in plain English

- Straightforward financing: Get pre-approved fast, with no pressure and no markup games.

- Fully remote service: Skip the dealership, the DMV lines, and the confusion. We’ll handle the hard parts, 100% online

Toyota Lease Buyout: FAQs

If we haven’t answered all of your questions above, here are some additional ones that might help you out.

How does a Toyota lease buyout actually work?

At its core, your lease spells out the price Toyota set for your car at lease-end. Don’t forget sales tax and local DMV fees, which usually get added on top. If you like the car and want to keep it, you can buy it for that amount, plus any taxes and fees.

Can I buy my Toyota before the lease ends?

You don’t always have to wait until the very last day of your lease. Toyota usually lets drivers buy out early, but it can come with strings attached, like covering the rest of your payments plus the buyout price, and sometimes an extra fee. Always check the fine print before you pull the trigger.

Is it cheaper to buy my Toyota or return it and lease a new one?

That depends on a few things: the current market value of your car, your residual value, and whether you’d need to pay new lease upfront costs again. If your car’s worth more than the buyout price, it might be a smart financial move to buy.

One Corolla lessee shared that their buyout was $14K, while Carvana valued it at $21.5K, turning the buyout into roughly $6.5K in instant equity.

What fees should I expect with a Toyota lease buyout?

Most buyouts include the residual value, sales tax, and possibly DMV and processing fees. The disposition fee (usually $350–$500) only applies if you return the vehicle; buying it helps you avoid that cost.

Can I finance the Toyota lease buyout?

Absolutely. Many drivers choose to finance their lease buyout through a bank, credit union, or a service like Lease End Department. Loan terms typically range from 24 to 60 months, with interest rates based on your credit.

Do I need to go to the dealership to complete a Toyota buyout?

Not necessarily. Lease End Department can handle your entire lease buyout online, including financing, DMV paperwork, and even plate delivery, so you never have to set foot in a dealership.