Here’s What Happens at the End of a Car Lease:

- You have 3 core options at lease-end: return the vehicle, lease a new one, or buy it

- Buying out your lease could save you thousands. If your residual value is $17,000 and your car is worth $20,000, you’re sitting on $3,000 in equity

- Expect end-of-lease fees between $500–$2,000 if you return the car with excess mileage, wear, or without inspection prep.

- Plan 60–90 days before your lease ends to avoid rush fees, limited inventory, and missed buyout opportunities.

- Over 80% of lease returns include some kind of penalty. Avoid this by scheduling a pre-inspection, cleaning the car, and fixing small damage before turn-in

If your lease is ending soon, that ticking clock might feel louder than usual.

Every month, thousands of drivers reach the end of their lease and ask the same questions.

Do I return the car? Can I buy it? What fees should I expect?

The upside is that a lease-end doesn’t have to mean giving up a car you like or experiencing hidden fees. With a bit of planning, you could turn what feels like an obligation into a smart investment.

In this guide, you’ll learn:

- What to expect in the final 90 days of your lease

- Your three main end-of-lease options and how to choose the best one

- Common fees (and how to avoid them)

- Why buying your leased car may save you thousands

- Why Lease End Department makes the process 100% online and stress-free

What To Expect When Your Car Lease Ends

The end of your car lease might feel like a finish line, but it’s actually the beginning of how to get of a car lease.

Here’s what typically unfolds and how to get ahead of it.

90 Days Out: The Countdown Begins

Most leasing companies will notify you about your lease maturity 90 to 120 days before the official end date.

This is your window to:

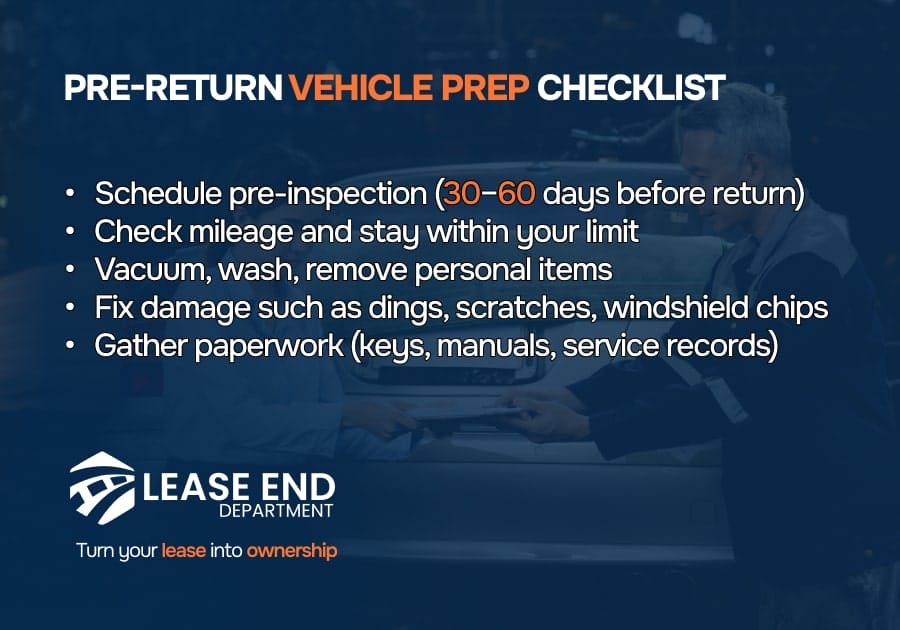

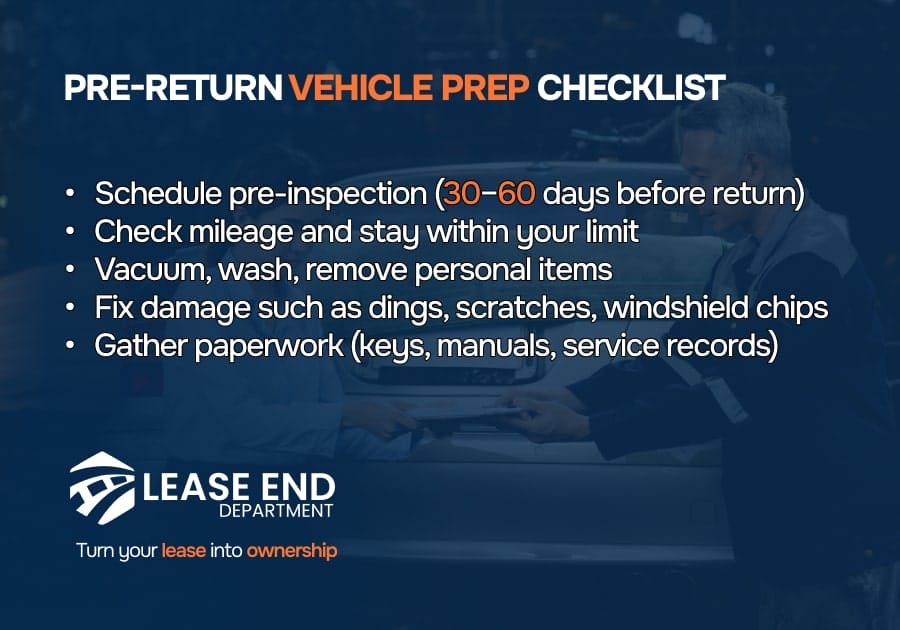

- Schedule a pre-return inspection: Don’t wait until the last minute. This inspection checks for wear, damage, and mileage overage, giving you time to fix anything before being charged

- Review your contract: Locate your residual value, mileage limits, and any end-of-lease fees. Knowing these numbers helps you compare return vs. buyout options intelligently

- Start researching options: If your current vehicle suits you, a buyout could save thousands, especially if used car prices are up

30–60 Days Out: Decision Time

Now’s the time to lock in your game plan and ask yourself questions such as:

- Want to return the car? Make sure you schedule your return appointment early, especially if your lease ends during a high-demand season

- Thinking of buying it out? Get a payoff quote and compare it to the car’s current market value. Many drivers are surprised to find their car is worth more than the buyout price

- Interested in leasing again? Some automakers offer loyalty bonuses or fee waivers if you stay within the brand, something worth asking about

Return Day: Paperwork, Keys & Final Fees

On return day, expect:

- A final inspection: Your car will be assessed again. If you skipped the pre-return check, this is where wear, damage, or over-mileage can cost you

- Fee breakdown: You’ll pay any outstanding costs such as disposition fees, extra mileage, damage charges, and possibly your last payment

- Decision confirmation: If you haven’t already bought the car or entered a new lease, this is the last call to change your path

How a Lease Works at the End of the Term

When your lease ends, it’s not just about turning in the keys. What actually happens is a blend of logistics, financial choices, and contractual obligations.

Let’s break it down step-by-step:

Your Final Payment & Notice Period

The lease doesn’t just end as you wrap up with a final scheduled payment.

This is often followed by:

- A disposition notice: This comes from the leasing company and outlines your return process, including deadlines and fee expectations

- Your residual value confirmation: This is the price you’d pay if you decide to buy the car. It’s been fixed since day one of your lease agreement

- A push for action: Lenders want you to commit, return, lease again, or buy. If you do nothing, some may automatically extend your lease month-to-month (usually at a higher rate)

What Happens if You Return the Car

Returning the vehicle doesn’t mean you’re off the hook right away:

- You may owe a disposition fee, typically $300–$500

- The car will undergo a final inspection for excess wear or over-mileage

- Unresolved fees or damage charges may be invoiced post-return, so keep a paper trail of all documentation

What if You Want To Keep the Car?

If you’ve grown to love your vehicle or simply want to avoid the current new car market, buying it out is completely allowed:

- You pay the residual value, plus any applicable taxes or buyout fees

- The process can be fast and online with a partner like Lease End Department with no dealership needed

Bonus: You avoid mileage and damage penalties entirely, since the car is now yours.

Mistakes To Avoid

Here’s where many leaseholders trip up:

- Waiting too long to make a decision, then facing rush fees or limited options

- Assuming buyouts must go through the original dealership

- Forgetting to compare the car’s residual value to its market price

Pro tip: If your car is worth more than the buyout price, that’s instant equity in your pocket.

What You Can Do When a Lease Is Up

Your decision here can have a serious financial impact.

Let’s break down the main options.

1. Return the Car and Walk Away

This is the default path most drivers expect. You hand in the keys, pay any applicable fees, and move on.

- Best for: Drivers who want a new car or no longer need a vehicle

- Costs to expect: Disposition fee, excess wear-and-tear charges, and mileage overage fees

- Watch out for: Returning without pre-inspection could result in surprise charges. Always get a wear-and-tear estimate beforehand

2. Lease or Buy Another Car

Many leasing companies will offer you a seamless transition into a new lease, or give you a quote to purchase the same vehicle.

- Best for: Drivers who want to upgrade or stay with the same brand

- Benefits: Some dealers offer loyalty perks, like waived disposition fees or early return forgiveness

- Consider: A buyout is smart if your current vehicle is worth more than the residual price

Example: If your lease buyout is $16,000 and the same model sells for $19,000 on the used market, you’re sitting on $3,000 of equity.

3. Buy Out Your Leased Car

This often-overlooked option can be the most financially sound, especially in today’s tight used car market.

- Best for: Drivers who’ve taken care of their car, driven over their mileage limit, or want to avoid a new car payment

- Biggest perk: You know the vehicle’s history, and the price is already set in your lease agreement

- How to do it right: Use Lease End Department to handle the financing, DMV paperwork, and title transfer that’s all 100% online

Lease End Department: Your Exit Strategy Made Easy

As your lease wraps up, you don’t have to face confusing paperwork, dealership pressure, or last-minute decisions alone. Lease End Department is here to simplify every step, especially if you’re considering buying out your vehicle.

Here’s how our process works:

- Personalized lease-end guidance: Just share your vehicle and lease details. We’ll walk you through your return, renewal, or buyout options, so you feel confident in your next move

- Fast pre-approval and financing: Thinking about keeping your car? We’ll help you get pre-approved for a buyout loan with competitive rates tailored to your credit and budget

- 100% online process: From paperwork to plate delivery, everything is done remotely. No dealership visits. No DMV lines

- Title and registration handled for you: We take care of all the documentation, so you don’t have to

What Happens at the End of a Car Lease? FAQs

What happens when your car lease is up and you do nothing?

If you don’t take action by the lease maturity date, some leasing companies automatically extend your lease on a month-to-month basis,often at a higher rate.

Can you negotiate the buyout price at the end of a lease?

In most cases, the buyout price (residual value) is fixed in your lease contract and non-negotiable. However, if the car has high wear or market value has dropped significantly, some lenders may be open to discussions, especially if they want to avoid processing a return.

Do you pay taxes at the end of a car lease if you buy the car?

Yes, if you choose to buy the car at lease-end, you’ll typically pay sales tax on the purchase price (residual value), plus title, registration, and possible dealer fees. Tax rates vary by state, and some states may allow you to finance taxes into your buyout loan.

What happens at the end of a 3-year car lease specifically?

The process is the same as any lease term. Whether it’s a 2-year, 3-year, or 4-year lease, your options are to return the car, buy it, or lease again. However, 3-year leases often coincide with manufacturer warranties expiring, so buying the car might also mean you’ll soon be responsible for repair costs.

What do you pay at the end of a car lease if you return it?

Expect to pay a disposition fee, which covers the dealer’s cost to resell the vehicle (typically $300–$500), along with any excess mileage (often $0.15–$0.30 per mile over your limit) and wear-and-tear charges.