Costs of Leasing a Car: Key Takeaways

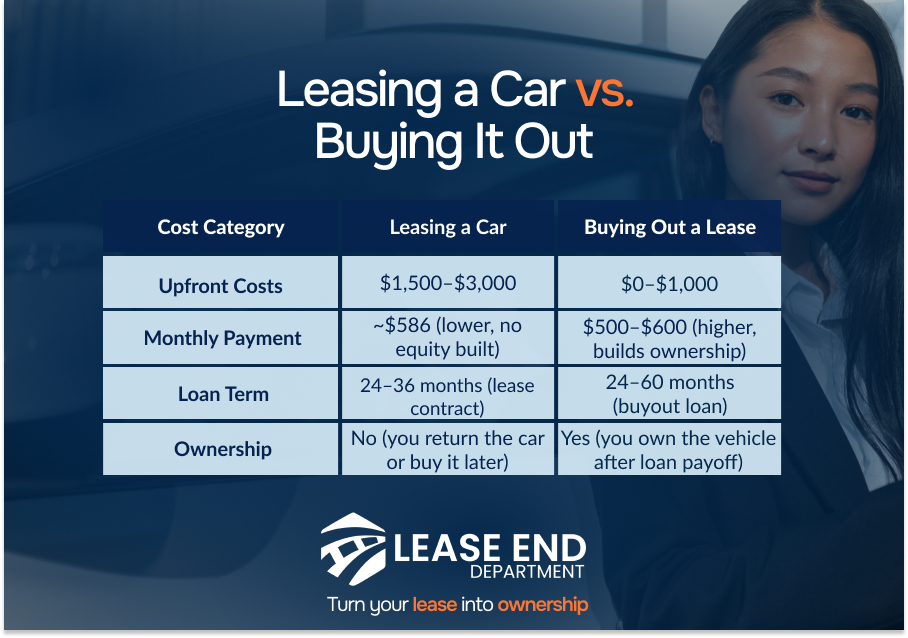

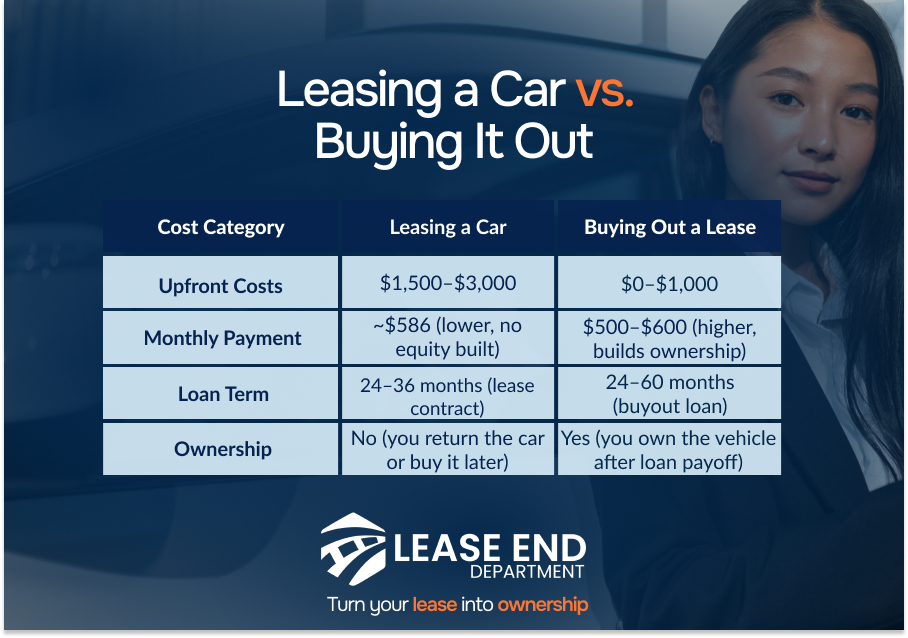

- Leasing a car costs an average of $581 per month in 2025, with typical upfront costs between $1,500 and $3,000 including acquisition and first-month fees

- Lease buyouts generally cost $15,000 to $25,000, depending on your car’s residual value, sales tax, DMV fees, and whether you buy early or at lease-end

- Monthly lease payments are lower than buyout loan payments but don’t lead to ownership; once the lease ends, you either return the car or pay more to keep it

- Buyout loans typically range from 24 to 60 months, with interest rates between 5.5% and 10.5% based on credit and lender terms

- Leasing can cost more over time if you exceed mileage limits (usually 10,000 to 15,000 miles per year) or get charged for wear-and-tear at lease-end

- Buying out your lease avoids return fees like the $300–$500 disposition fee and lets you keep the car you’ve already maintained and driven

Thinking about leasing a car or buying out your current one?

The numbers matter more than ever.

Lease payments might feel easier on your budget month-to-month, but if you’re thinking long-term, the total cost to buy out your vehicle can land anywhere between $15K and $25K.

But here’s the big question: Which option gives you better value for your money?

The answer depends on your budget, how long you plan to keep the car, and what’s included in each option’s total cost.

In this guide, you’ll learn:

- How much it actually costs to lease a car

- What goes into a lease buyout quote

- How monthly payments and fees compare

- When leasing makes more sense and when it doesn’t

- How to decide based on long-term value

Leasing a Car Cost Breakdown

Leasing a car usually means lower monthly payments upfront, but it comes with its own set of costs that add up over time.

1. Upfront Costs

Most lease contracts require some initial cash outlay. Common charges include:

- Down payment or capitalized cost reduction (optional but common)

- First month’s lease payment

- Acquisition fee, usually between $400 and $900

- Security deposit (sometimes waived for top-tier credit)

Example: For a $30,000 car, you might pay $2,000 to $3,000 at signing, depending on promotions or dealer terms.

2. Monthly Payments

Lease payments are typically based on:

- The car’s depreciation over the lease term

- Money factor (your lease interest rate)

- Residual value (what the car is worth at lease-end)

Average monthly lease payment in 2025: around $586, though luxury vehicles and SUVs can exceed $700.

3. Additional Costs To Expect

- Mileage overages: $0.15 to $0.30 per mile if you exceed your limit (usually 10,000 to 15,000 miles per year)

- Wear-and-tear charges: Scratches, dents, or worn tires could mean extra fees

- Disposition fee: $300 to $500 due if you return the car without buying it

Pro tip: One thing drivers often miss? The fine print on mileage limits and end-of-lease fees can hit harder than expected, ask upfront and save later.

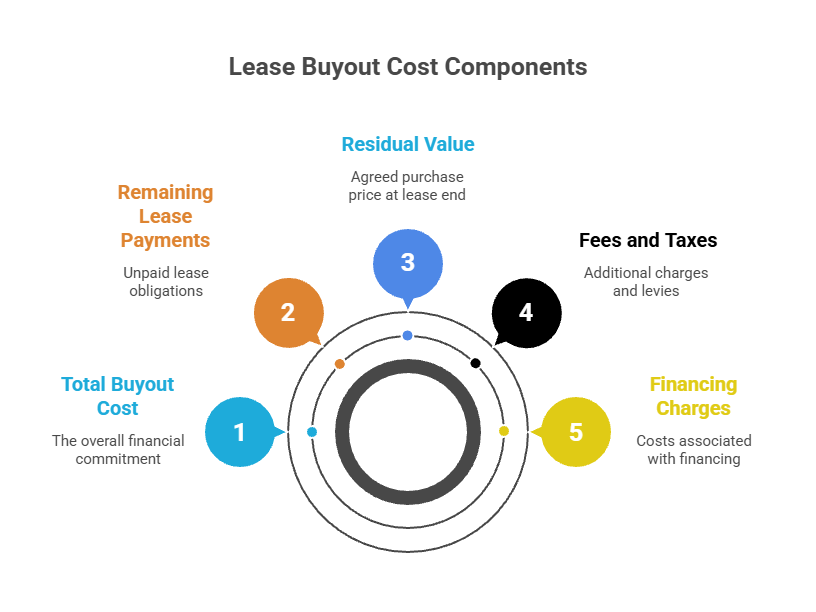

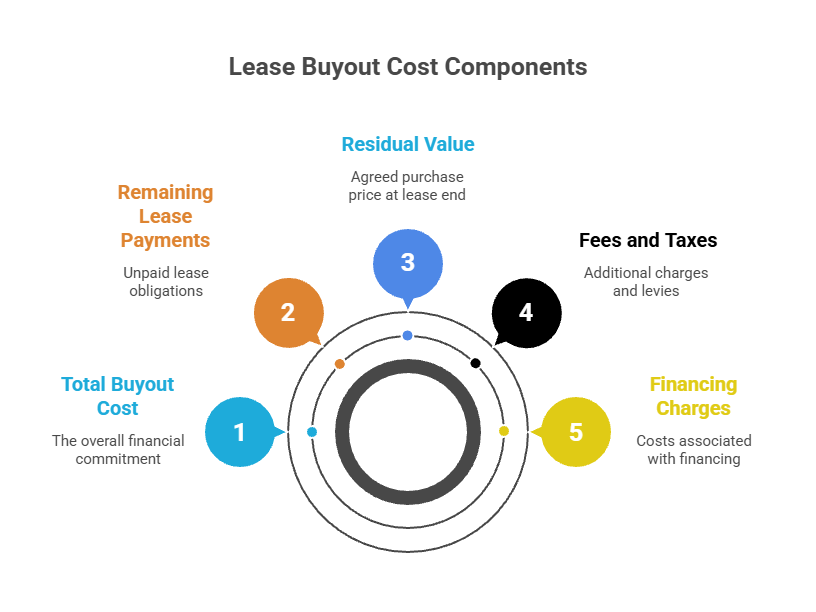

What It Costs To Buy Out a Lease

A lease buyout lets you purchase your leased car, either at the end of the lease or earlier, usually for the residual value plus taxes and fees.

Key Components of a Lease Buyout

When you buy out a lease, your total cost typically includes:

- Residual value: Pre-agreed buyout price listed in your lease contract

- Remaining lease payments: For early buyouts only

- State sales tax on the buyout price

- Title and registration fees

- Dealer or processing fees (may range from $200 to $700)

Real-World Example

Let’s say your residual value is $17,500, and you’re buying at lease-end. Depending on your state, your total buyout might look like this:

- Residual value: $17,500

- Sales tax (6.5%): $1,138

- DMV and title: $300

- Total buyout cost: Around $18,900

Financing Your Buyout

If you don’t want to pay the full buyout in cash, you can finance it with a lease buyout loan. Here’s what to keep in mind:

- Loan terms typically range from 24 to 60 months, depending on your lender and credit profile

- Interest rates can vary widely, from 5.5% to 10.5% in 2025. Your credit score, income, and the car’s age all influence your rate

- Monthly payments may be higher than a lease, but you’re building ownership and avoiding future lease payments or penalties

Pro tip: Always compare your buyout amount to the vehicle’s current market value before financing. If your car is worth more than the buyout, you’re likely getting a good deal.

Comparing Monthly Payments and Fees

You’ll probably pay less each month with a lease, but there’s a catch. That lower number doesn’t build you any ownership, and fees can sneak in if you’re not careful.

Lease Payments

- Usually lower because you’re only paying for depreciation during the lease term

- Don’t build ownership equity

- May include fees for excess mileage or wear-and-tear

- Often require a disposition fee at lease-end if you return the car

Buyout Loan Payments

- Usually higher than lease payments, but lead to full ownership

- No disposition fee or return penalties

- Can be refinanced for better terms

- Build equity if your car is worth more than the payoff amount

- Can be a flexible exit strategy if you want to end your lease early by buying the car and reselling or refinancing

CTA: Want to keep your car? Talk to Lease End Department.

Long-Term Value: Leasing vs Buying

Leasing may offer short-term savings, but buying often wins in the long run, especially if you plan to keep the vehicle beyond the lease term.

Here’s how both options compare when it comes to long-term value.

Leasing a Car

- Lower upfront and monthly costs, ideal for short-term budgeting

- No ownership at lease-end, which means you’re always making payments

- Mileage and wear limits can result in fees if you’re not careful

- You’ll need to lease or buy again every few years, often with new down payments

Buying Out Your Lease

- You keep the car, gaining full ownership after the loan is paid off

- No more monthly payments once the loan is done, potential long-term savings

- You avoid return penalties, like wear-and-tear or mileage fees

- You may have equity if the vehicle’s market value is higher than the buyout price

Example: Let’s say you finance a lease buyout at $18,000 and pay it off over three years. After that, the car is yours, and may still be worth $10,000 or more if you decide to sell a leased car or trade it in.

How Lease End Department Helps You Choose the Smarter Path

Not sure what your next move should be? That’s where Lease End Department steps in.

We help you break down the numbers, compare monthly payments, and make the decision that fits your long-term goals, without pressure or dealership upsells.

Here’s how we support your next step:

- Personalized lease analysis: We’ll review your lease terms, payoff quote, and the car’s market value so you can see the full picture.

- Buyout loan pre-approval: Want to keep your car? We offer fast, flexible financing options tailored to your budget.

- 100% remote service: No dealership visits. We handle title transfers, registration, and even plate delivery from start to finish.

- Why Lease End Department? Because we put control back in your hands, with clear numbers and expert guidance.

Cost To Lease a Car: FAQs

How much does it cost to lease a car?

The average monthly lease payment in 2025 is around $581, though it can vary widely based on the vehicle’s price, lease term, and your credit. Upfront costs typically include a down payment, acquisition fee, and the first month’s payment, often totaling $1,500 to $3,000.

Is it cheaper to lease a car or buy it out?

Leasing usually costs less upfront and month-to-month, but a lease buyout can offer better long-term value, especially if your car is worth more than the buyout price. If you plan to keep the vehicle for several years, buying it out may save you thousands.

What is the average lease payment?

In the U.S., the average lease payment is just under $600 per month. Luxury models and SUVs can push this closer to $700 or more.

Can I finance a lease buyout?

Yes. Many drivers use a lease buyout loan to spread payments over 24 to 60 months. Rates depend on your credit, income, and vehicle condition. Pre-approval helps you avoid dealer markups.