Third Party Lease Buyout: Key Takeaways

- A third-party lease buyout means someone else, like a lender, dealership, or lease specialist, buys your leased car, not you

- Not every automaker allows it. Honda, Toyota, and some others have strict no-transfer policies, so always check your lease terms first

- If your car is worth more than your lease payoff, a third-party buyout can help you unlock thousands in equity without visiting the dealership

- It’s a great way to avoid dealer markups, access outside financing, or sell your leased car outright

- Lease End Department handles everything, from payoff to paperwork to plate delivery, so you don’t have to deal with the DMV or pushy salespeople

Roughly one in three drivers considered a third-party lease buyout in 2024 as used car prices remained high and dealership fees added pressure at lease end.

If you’re trying to avoid dealer markups or wondering if you can cash in on your car’s equity, a third-party lease buyout might be the smarter move.

But there’s a catch, not all automakers allow it, and the process comes with fine print.

In this guide, we’ll cover:

- What a third-party lease buyout actually means

- The step‑by‑step process you’ll follow

- Typical costs and fees you’ll face

- Restrictions from automakers and lenders

How a Third-Party Lease Buyout Works

Getting someone else involved in your lease might sound like a hassle, but a third-party buyout could actually be your best move if you’re trying to dodge dealership games

This can help you avoid dealer markups, tap into vehicle equity, and move forward with far less friction.

Here’s how the process usually works:

1. Get Your Lease Payoff Quote

Reach out to your leasing company and request a payoff amount, which typically includes:

- The residual value (what the car’s worth per your contract)

- Any remaining payments if you’re getting out of the car lease early

- Applicable fees and taxes

Before moving forward:

- Check if your leasing company allows third-party lease buyout options. Some automakers restrict this option, especially close to lease-end

- Ask if the payoff quote is dealer-inflated. Go directly to the leasing bank for an accurate number

- Compare the quote to your car’s market value using tools like Carvana, Edmunds, or KBB. If your car is worth more, you could be sitting on real equity

2. Partner With a Third-Party Buyer

Submit your vehicle and lease details to a third-party provider like Lease End Department.

From there, we’ll:

- Match you with tailored financing options

- Confirm eligibility based on your brand and lease terms

- Guide you through the next steps, no dealership required

3. Finalize the Buyout and Transfer Ownership

The third party pays off the lease, and the title transfers, either to you or a new buyer.

We also:

- Handle DMV paperwork and registration

- Ship your license plates if needed

- Provide full transparency so you know what every step costs

Advantages of Third-Party Lease Buyouts

Not sure if a third-party lease buyout is right for you? Here’s a quick checklist of the biggest advantages, especially if you’re nearing the end of your lease and looking to avoid dealership drama:

You Want To Avoid the Dealership

Tired of the pressure and games at lease-end?

- There’s no pressure to re-lease or buy another car

- Skip the markups, upsells, and wait times

- Work directly with a service that represents your best interests

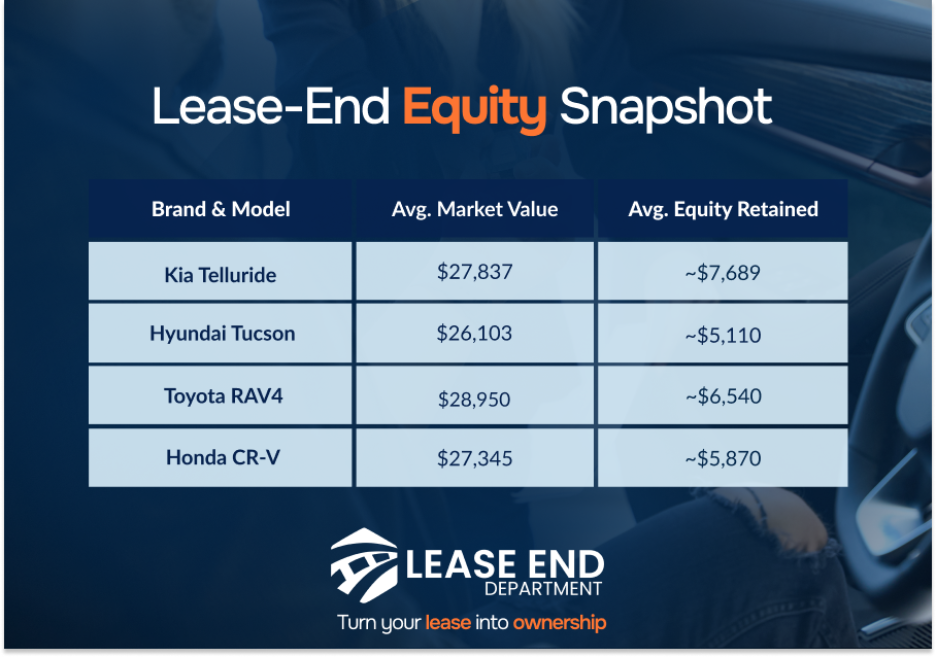

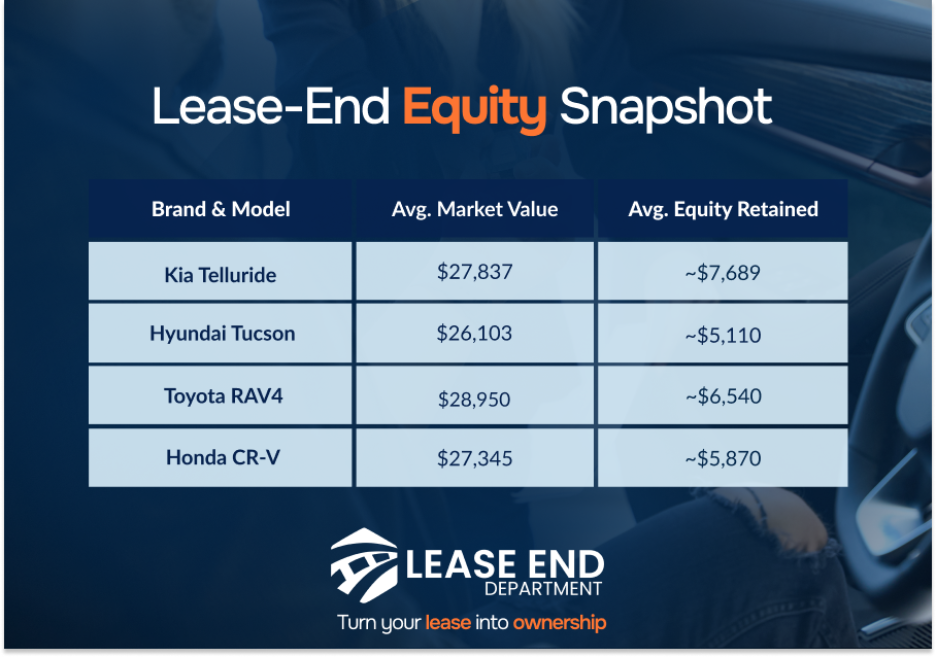

Your Car Is Worth More Than the Buyout Price

Let’s say your car’s worth more than what you still owe on the lease. Congrats, you’ve just found hidden money.

- Used car market hasn’t cooled off, which means better odds of equity in your lease

- That difference between payoff and market value? It’s your equity

- You could walk away with cash or put it toward your next car

You Need Better Financing Options

Why settle for the dealership’s rate when you can shop smarter?

- Third-party services can shop around like you would for flights, faster and cheaper

- Lower monthly payments compared to in-house dealership lease buyout loans

- Pre-approval without impacting your credit right away

You Want Flexibility After the Buyout

Once the car’s in your name, you’re in the driver’s seat, literally and financially.

- Keep the car, sell it, or trade it, your choice

- No mileage limits or cosmetic penalties

- Refinance under your name with updated terms

You’re Trying To Minimize End-of-Lease Fees

Lease returns often come with surprise charges. Why pay them if you don’t have to?

- Disposition fees, excess mileage, or wear-and-tear charges can add up

- Buying out the car avoids those penalties entirely

- More control over how and when the lease ends

Third‑Party Lease Buyout Costs and Fees

A third-party lease buyout can save you money, but it still comes with a few important costs. Some are standard, while others depend on your state, leasing company, or the timing of your lease buyout.

Here’s what you’ll typically pay, and how those costs break down in the real world.

What’s Typically Included

These are the core fees most buyers encounter, but the actual cost can vary, especially once taxes and third-party policies come into play.

- Residual value: Pre-set in your lease contract

- Sales tax: Varies by state; typically 5% to 8%

- Title and registration fees: Usually $100–$300

- Dealer or third-party documentation fees: Can range from $200–$700

- Inspection, delivery, or transfer fees: May apply if the car is appraised or moved

- Early termination or remaining payments: Only if you’re buying out before lease-end

Sample Cost Breakdown

| Item | Estimated Cost |

| Residual / Payoff Amount | $18,000 |

| Sales Tax (6.5%) | $1,170 |

| Title / Registration Fees | $200 |

| Documentation / Admin Fee | $300 |

| Inspection or Delivery Fee | $100 |

| Estimated Total | $19,770 |

Real-World Examples

As you can see, small differences in fees or state tax rates can shift your total by hundreds, so it pays to get an accurate payoff quote before you commit.

- Sales tax: If your payoff is $18,000 and your state’s tax is 6.5%, you’ll owe about $1,170 in tax, bringing the total to $19,170. One driver on a Leasehackr forum mentioned their third-party buyout in California, and their biggest concern was figuring out how to avoid paying sales tax twice, especially when planning to sell the car afterward. It’s a real issue, and if you’re in a state with strict tax laws, it pays to know how to navigate that early.

- Title and registration fees: These typically run $100 to $300, depending on your DMV rules

- Dealer or processing fees: Some dealerships charge $599+ in doc fees, especially during buyout. One Redditor shared their experience buying out a Toyota lease through a third party in California. They had a bank loan ready to cover the $31,000 payoff, but didn’t realize until later that DMV sales tax and registration fees would tack on nearly $3,000 more.

- Third-party restrictions: Certain lenders increase the payoff amount if the buyer is not you, adding unexpected costs or delaysne

Restrictions From Automakers and Lenders

Not every automaker allows third-party lease buyouts, and those that do may limit when or how you can complete one.

Here are the most important restrictions to know:

- Some brands prohibit third-party buyouts entirely: Honda, Acura, Toyota, and Kia often block non-dealer buyouts during or at the end of a lease. Brands like Ford, GM, and some luxury brands (e.g., BMW, Audi) may allow them; check the fine print

- Lenders may inflate the payoff amount for third-party buyers: Some leasing companies charge higher buyout prices if you’re not the person on the lease

- Third-party timing matters: Some automakers only allow third-party buyouts during the middle of the lease, not in the final 90 days

- Private party sales are often blocked: Many lenders will only approve a third-party buyout if the buyer is a licensed dealer or leasing service

- State laws may limit title transfers: In states like California and New York, title release times and tax rules can delay or complicate third-party buyouts

Your Lease, Your Rules, With Help From Lease End Department

A third-party lease buyout isn’t always simple, but if your leasing company allows it, it can help you avoid markups, unlock equity, and take control of your next move. And with the right partner, you don’t have to figure it all out alone.

Lease End Department makes the entire process easy:

- We check if your lease allows a third-party buyout

- We show you the numbers clearly, no pressure, no surprises

- We handle the paperwork, title transfer, registration, and even plate delivery

Plus, we specialize in lease buyouts for popular brands, including:

Whether you’re ready to buy out your lease or just exploring your options, we’re here to help you make the smart move, 100% online.

Third-Party Lease Buyouts: FAQs

Still have questions? You’re not alone. Here are some of the most common concerns drivers have when exploring a third-party lease buyout, and what you need to know before moving forward.

Can I do a third-party lease buyout with any car brand?

Not always. Some automakers, like Honda, Toyota, Kia, and Hyundai, limit or block third-party buyouts. Lease End Department can quickly check your lease terms and let you know what’s allowed.

What’s the difference between a direct buyout and a third-party buyout?

Think of a direct buyout like buying the car straight from your lender. A third-party buyout? That’s like having a middleman step in, someone else takes over the payoff while you keep control.

Can I sell my leased car to someone else?

Yes, but only if your leasing company allows it. Some require that the buyer be a licensed dealer. If approved, this is done through a third-party lease buyout.

Is a third-party lease buyout legal in every state?

Yes, but state rules can affect taxes, title transfers, and timing. For example, California and New York often have longer processing times for title releases.

Do I still pay sales tax on a third-party lease buyout?

In most cases, yes. You’ll still owe sales tax on the buyout, even if you’re skipping the dealer, but how much depends on where you live.

Can a third-party back out during the process?

It’s rare, but possible. That’s why working with a verified lease service like Lease End Department gives you more stability and support.

Does a third-party lease buyout affect my credit?

No, unless you fall behind on payments or fail to complete the process. As long as the payoff is completed and the title is transferred properly, your credit remains unaffected.

Can I really walk away with equity on a lease? That sounds too good to be true.

If your car’s market value is higher than what you still owe, that gap is all yours. It’s like finding a $2K bonus in your glovebox. Just be sure your leasing company doesn’t block third-party sales.