Chrysler Lease Buyout: Key Takeaways

- A lease buyout lets you keep the Chrysler you already know and trust

- The buyout price isn’t just what’s left on paper; taxes and a few other fees sneak in too

- If your car’s market value is higher than the payoff, buying could save you money

- Give yourself a head start as looking into it a month or two early means fewer last-minute headaches

- Lease End Department makes financing easy with fast pre-approvals and flexible terms

Your lease is ending, but your Chrysler still fits your life. Sound familiar?

You know the car. You trust it. It’s taken the kids to school, made grocery runs feel like road trips, and maybe even saved you during that surprise snowstorm.

Now the paperwork says it’s time to give it back. But something about that doesn’t sit right.

If you’re thinking about keeping the car you already know, one that’s already proven itself, this one is for you.

In this guide, we’ll cover:

- How to Chrysler lease buyout process works

- Chrysler lease buyout fees & prices you can expect

- Pros & cons of a Chrysler lease buyout

Chrysler Lease Buyout: Key Facts

Many drivers are choosing to buy out their leased cars, especially when they’ve been well cared for and still meet their needs.

Here’s what to know before you start the process:

- What is a Chrysler lease buyout? It’s the option to purchase your leased vehicle usually at the end of your lease, for a pre-set amount called the residual value. You may also have the option to buy early, depending on your lease terms.

- Who handles the buyout? Most Chrysler leases are managed through Chrysler Capital, the financial arm of Stellantis. That number comes straight from Chrysler Capital, so don’t be surprised if the dealer sends you there.

- When can you buy the car? You can typically buy your Chrysler at lease-end or earlier, though early buyouts may include additional fees or remaining lease payments.

- Why buy instead of return? If your vehicle’s market value is higher than the buyout price, you may have equity. Plus, buying out your lease lets you avoid mileage overage charges, wear-and-tear fees, and dealer markups.

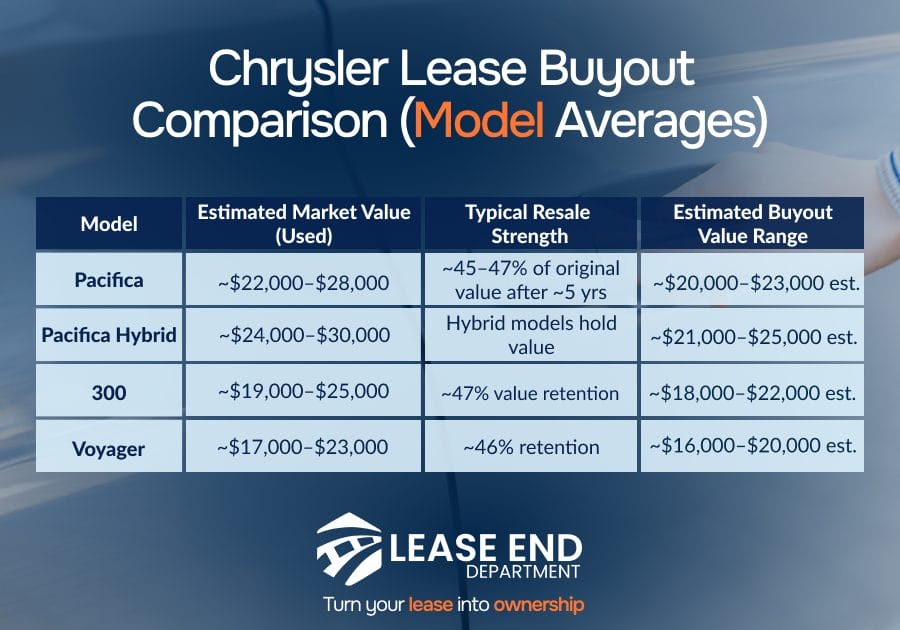

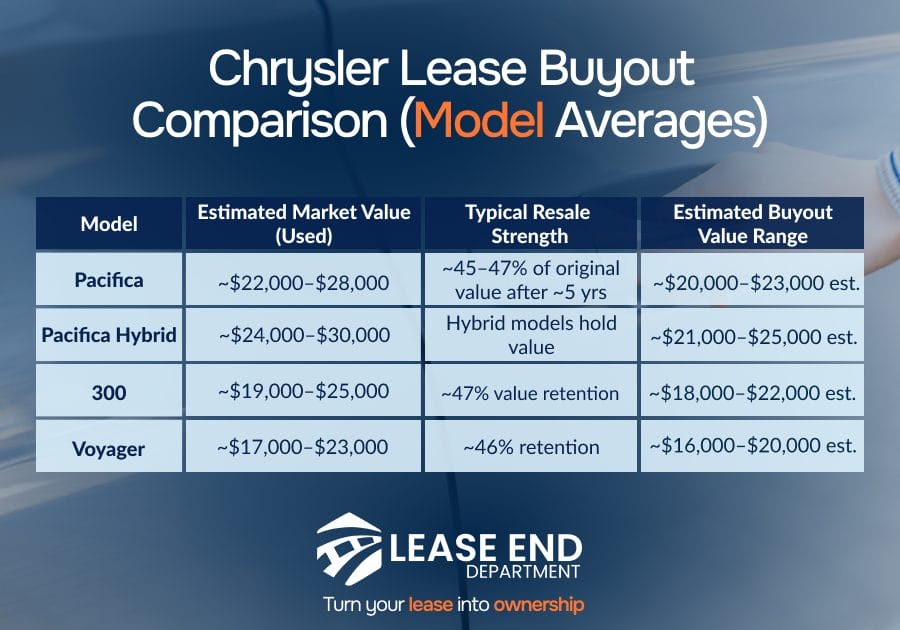

- Which Chrysler models retain value? Vehicles like the Chrysler Pacifica, 300, and Voyager tend to hold their value well, making them strong buyout candidates in today’s used market.

Pro tip: Even if you’re not sure about buying yet, request your payoff quote at least 30 to 60 days before your lease ends. Knowing your numbers gives you more time to plan, compare, and stay in control.

How the Chrysler Lease Buyout Process Works

So your car lease is ending, you found a good lease buyout option or maybe you’re just ready to make your Chrysler yours?

Here’s how to move from leased to fully yours, step by step.

1. Request Your Lease Payoff Quote From Chrysler Capital

Every decision starts with a number. And this is yours.

Here’s what to ask for in your official payoff quote:

- The residual value (your pre-agreed purchase price)

- Any remaining payments if you’re buying out early

- Taxes, purchase option fee, and registration charges

- Request it online or by phone directly from Chrysler Capital

Example: If the residual value is $19,000, but you owe two $375 payments and 7% in tax, your full buyout price is closer to $21,000.

2. Compare Your Payoff to Your Chrysler’s Market Value

What your car is worth to you is one thing. What it’s worth to the market? That’s what helps you decide.

Here’s how to check if the buyout makes financial sense:

- Use Kelley Blue Book, CarMax, or Edmunds for real-time market value

- If your Chrysler is worth more than your buyout price, you have equity

- That equity can fuel your next loan, boost a trade-in, or become profit if you sell

Example: A Chrysler Pacifica with a $20,000 buyout and a $23,000 market value gives you $3,000 in equity. That’s yours to keep.

3. Decide When To Buy: Now or at Lease-End

Time affects money and your strategy. When you buy matters as much as what you pay.

Here’s what to consider:

- Early buyouts may include remaining payments or an early termination fee

- Lease-end buyouts are simpler, but you risk wear-and-tear charges or mileage fees

- If you’re pushing your mileage cap, early may save you more

Example: If you’re 4,000 miles over and facing a $0.25/mile charge, buying early could save you $1,000 in fees.

4. Choose How To Pay: Cash or Financing

Ownership doesn’t have to mean one big check. It just needs a smart plan that fits your life.

Compare your financing options:

- Lease End Department offers buyout financing with quick online pre-approvals

- Your bank or credit union may have alternative terms

- Monthly payments give you ownership without an upfront hit to your savings

Example: Financing $20,000 at 6.5% APR over 60 months? That’s about $390/month, often less than leasing a new car.

5. Complete the Paperwork and Take Ownership

This is where it becomes real. The final step is also the most satisfying, because now, the car is truly yours.

Here’s what happens next:

- Pay Chrysler Capital directly or through your lender

- Receive the title, complete registration, and handle state filings

- Lease End Department handles it all, from title transfer to plate delivery and no DMV visits required

Example: Most drivers who use LED finish the entire buyout process online without setting foot in a dealership or government office.

Chrysler Lease Buyout Price: What You’ll Pay

Your lease buyout cost isn’t just one number, it’s a combination of several key pieces. Knowing what each one means can help you decide whether buying out your Chrysler is a smart financial move.

Here’s how to break it down:

- Residual value: This is the pre-set price to purchase your Chrysler, agreed upon when you signed the lease. Most Chrysler leases set this at 50% to 60% of the original MSRP, depending on your term and mileage allowance.

- Sales tax: Required in most U.S. states, calculated on the total buyout amount. Expect 5% to 10%, depending on where you live.

- Purchase option fee: A flat fee, typically $300 to $500, added to the buyout price. It’s listed in your lease agreement.

- Title and registration fees: These state-required fees range from $100 to $300, depending on your location.

Early Buyout Costs (if Applicable)

If you’re buying out before the end of your lease, your payoff may include:

- Remaining lease payments

- An early termination fee (typically $200 to $600)

- Any unpaid fees or taxes

Real-World Example: 2021 Chrysler Pacifica Touring L

Let’s say you leased a 2021 Chrysler Pacifica Touring L with an MSRP of $38,000. You’re nearing the end of your lease and considering a buyout.

Here’s how the estimated cost might break down:

- Residual value (54%): $20,520

- Sales tax (7%): $1,436

- Purchase option fee: $400

- Title and registration: $200

Estimated total buyout cost: $22,500–$23,000

Pros and Cons of Buying Your Leased Chrysler

Not sure if buying out your Chrysler lease is the right move? Here’s a quick look at the upsides and the trade-offs, to help you decide with confidence.

Pros

- Keep a car you know and trust: You already know how it drives, how it’s been maintained, and that it fits your lifestyle

- Avoid lease-end charges for mileage or cosmetic wear: If you’re over your mileage limit or have minor damage, buying the car means skipping those costly end-of-lease penalties

- May have equity to keep or use: If your Chrysler is worth more than your buyout price, that difference is yours, whether you keep it, sell it, or refinance

- No dealership markups or new-car pricing: Skip inflated prices and unwanted add-ons by buying a car you already know, without stepping into the showroom

Cons

- Out-of-pocket cost or need to finance: Buying your lease means paying thousands upfront or taking out a loan, either way, it’s a financial commitment

- Vehicle may be out of warranty: If your lease is ending, your factory warranty might be too. Repairs and maintenance could come out of pocket unless you add coverage

- New financing rate may be higher than new-car promos: Used-car loans typically don’t come with the same low APRs offered on brand-new vehicles

- You lose the flexibility of returning the lease: Ownership means responsibility, if your needs change, you can’t just walk away at lease-end

How Lease End Department Makes Your Chrysler Lease Buyout Easy

If your Chrysler still fits your life, buying it out could be the smartest move, especially when you skip the dealership and let Lease End Department take care of the details.

Here’s how we help drivers like you turn leases into ownership, minus the stress:

- Fast payoff quotes and side-by-side comparisons so you can make an informed decision

- Buyout financing options tailored to your credit and budget, with quick online pre-approvals

- Full-service support, including title transfer, registration, and plate delivery, no DMV visits required

- Everything done 100% online, with no dealership pressure or upsells

Besides Chrysler, we also specialize in lease buyouts for popular brands, including:

Thousands of drivers have used Lease End Department to keep the car they already trust. Ready to make your move?

Chrysler Lease Buyout: FAQs

Lease buyouts can feel confusing at first, but they don’t have to be, start here with the most common Chrysler buyout FAQs.

What is a Chrysler lease buyout?

A Chrysler lease buyout allows you to purchase your leased vehicle usually at the end of the lease term, by paying the residual value plus any applicable fees, taxes, and charges.

Can I buy my Chrysler before the lease ends?

Yes. Most Chrysler Capital leases allow for an early lease buyout. You’ll typically pay the remaining lease payments, the residual value, sales tax, and possibly an early termination fee.

How do I get my Chrysler lease payoff amount?

You can request your lease payoff quote directly from Chrysler Capital online or by calling their customer service line. The quote will include your residual value, taxes, fees, and any remaining payments.

Is it worth buying out my leased Chrysler?

It might be, especially if your Chrysler’s current market value is higher than the lease buyout price. This could give you equity and help you avoid lease-end charges for mileage or wear.

Can I finance my Chrysler lease buyout?

Yes. You can finance your buyout through Lease End Department, your bank, or a credit union. Lease End Department offers fast pre-approvals and competitive rates with no dealership involvement.

Do I have to go to a Chrysler dealership to complete the buyout?

No. With Lease End Department, you can handle the entire Chrysler lease buyout process online, including financing, title transfer, registration, and plate delivery.

What happens if I wait too long after my lease ends?

If you don’t act before your lease maturity date, you may face lease extension fees or limited buyout options. It’s best to explore your Chrysler lease buyout at least 30 to 60 days before your lease ends.