Mercedes Lease Buyout: Key Takeaways

- A Mercedes lease buyout lets you hold onto the luxury vehicle you already know without the hassle of starting fresh

- Your buyout price includes more than just the residual price, so don’t forget to factor in taxes, fees, and timing

- If your car’s market value is higher than the payoff amount, you could be buying it at a profit for less than it’s worth

- Financing through Lease End Department gives you flexibility and speed, without the pressure or upsells of a dealership

- Starting the process early gives you more room to compare lease buyout options, avoid surprises, and take full control of your next move

Some decisions are transactional. Others are transformational.

Leasing a Mercedes‑Benz was a smart move. But now that your lease is nearing its end, you’re facing another kind of choice, not just about a car, but about value, timing, control, and ownership.

And you’re not alone. Nearly half of all lease buyouts in 2024 were completed by drivers under age 45, showing a broad shift toward keeping the cars people already know rather than starting over.

This isn’t about starting over. It’s about deciding whether the car you already know deserves a permanent spot in your garage.

In this guide, we will cover:

- How a Mercedes‑Benz lease buyout works and what makes it different from a return

- What you’ll pay: residual value, taxes, fees, and lease‑end costs

- Pros and cons of keeping your Mercedes versus returning it

- Financing and payment options, including Mercedes Financial Services and LED alternatives

- Common mistakes that could cost you money

Mercedes-Benz Lease Buyout: What You Should Know

At the end of a luxury lease, it’s not just about returning a car, it’s about deciding whether to keep a vehicle that already fits your life, your style, and your standards.

Here’s what to weigh before you buy:

- Is it only about the price or is it timing as well? Your residual value might be locked in, but market conditions shift. If used luxury prices are strong, your Mercedes may be worth more than your buyout amount, especially if it’s been well maintained.

- Mileage and condition matter more than you think. If you’ve driven well over your lease allowance or your vehicle has minor dings, buying it out may be cheaper than paying return penalties. Going 6,000 miles over at $0.25/mile adds $1,500 in fees, often more than the financing cost of early ownership.

- Early vs lease-end buyout? Mercedes lessees with high mileage or cosmetic wear often benefit from an early buyout. End-of-term is smoother but may come with surprise charges, especially for premium brands with strict lease-return inspections.

- You’re dealing with Mercedes Financial Services, not just the dealer. Most Mercedes-Benz leases are managed through MFS, meaning your buyout and payoff details come from them. Sure, the dealer might “have a guy” for that. But this decision? It’s 100% yours.

- Some models hold their value better than others. Mercedes GLE, GLC, and C-Class often retain higher resale values, making them better candidates for buyouts. A 2020 GLC with a residual of $27,500 could be worth $31,000+ on the resale market, giving you real equity.

How the Mercedes-Benz Buyout Process Works

Just because it’s a Benz doesn’t mean the process has to be complex. If you’re thinking about keeping your Mercedes, the buyout process is more approachable and more in your control than most drivers expect.

Here’s how to move from leased to owned with clarity and confidence.

Step 1: Check Your Lease-End Timeline and Payoff Quote Through MFS

Start by understanding your timeline. Whether you’re months from maturity or just weeks away, your first move is to request an official payoff quote from Mercedes-Benz Financial Services.

What to ask for:

- Your residual value (pre-set buyout amount)

- Any remaining payments if buying out early

- Sales tax, purchase option fee, and potential DMV charges

Request online or by calling MFS directly, with no dealer needed.

Tip: Payoff quotes are usually valid for 10 days. If your car lease ends soon, don’t wait. Lock in your number so you can explore financing and market value while it’s still accurate.

Step 2: Compare Your Residual Value to Market Pricing

Before you say yes to the buyout, make sure you’re not overpaying or missing out on equity.

How to evaluate:

- Use KBB, Carfax, Edmunds, or even Mercedes CPO listings

- Check prices on models with similar year, trim, and mileage

- If your vehicle’s value is higher than your residual, you’re essentially buying it at a discount

Example: A 2020 Mercedes GLE with a $29,000 residual could be worth $33,000 on the resale market, giving you $4,000 in equity if you buy it out.

Step 3: Decide When to Buy: Early or at Lease-End

Timing affects everything from fees to flexibility.

Here’s what to consider:

- Early buyouts may include remaining payments or small fees, but let you avoid lease return penalties

- Lease-end buyouts are simpler paperwork-wise, but you might face charges for excess wear or mileage

- Choose based on your driving habits, car condition, and financial timeline

Tip: If you’re 5,000 miles over your lease limit, that’s $1,250 in fees at $0.25/mile. An early buyout could sidestep that cost entirely.

Step 4: Choose Your Payment Method: Cash or Financing

How you pay is just as important as when you pay. Mercedes leases don’t always include lease-end financing, so it pays to compare.

What to consider:

- Cash avoids interest, but isn’t ideal if it drains your reserves

- Lease End Department offers pre-approvals for loans with flexible rates and terms

- Compare options with your bank or credit union too

Example: Financing a $30,000 buyout over 60 months at 5.9% APR means a monthly payment of about $580, often less than a new luxury lease.

Step 5: Finalize Paperwork and Take Full Ownership

Now it’s about making it official. Once you’ve locked in your buyout terms:

- Submit payment to MFS or your lender

- Transfer the title, register your Mercedes, and pay any state fees

- Lease End Department can handle all paperwork, DMV filings, and even plate delivery, completely online

Tip: Most drivers spend hours chasing title documents and waiting at the DMV. LED does it for you, so your time stays yours.

Mercedes-Benz Buyout Price: Costs, Fees, and Taxes

Luxury comes with a price tag, but when you’re buying out your Mercedes lease, that price deserves clarity.

What Goes Into Your Mercedes Lease Buyout?

Beyond the residual value, a few extra line items can significantly affect your total buyout cost.

What’s included in the full picture:

- Residual Value: This is the pre-set price in your lease agreement. For most Mercedes-Benz models, it lands between 50% and 58% of MSRP. Example: A 2020 C-Class with a $42,000 MSRP might have a residual around $22,500.

- Purchase Option Fee: Most Mercedes leases include a buyout fee between $595 and $795, non-negotiable and listed in your original lease paperwork.

- Sales Tax: Based on your state and local tax rate, expect to pay 6% to 10% of your buyout amount. On a $28,000 payoff, that’s $1,680–$2,800 in tax alone.

- Registration and Title Fees: Premium cars often incur slightly higher DMV costs. Budget $200–$500 for registration, title transfer, and plate re-issuance.

- Early Termination Fee (if applicable): Only relevant if you’re buying out before lease-end. This might include a few remaining payments or a flat fee. Check your contract.

- Inspection Fees: Not required when buying, but some dealers still try to schedule one. Politely decline if you’re not returning the vehicle.

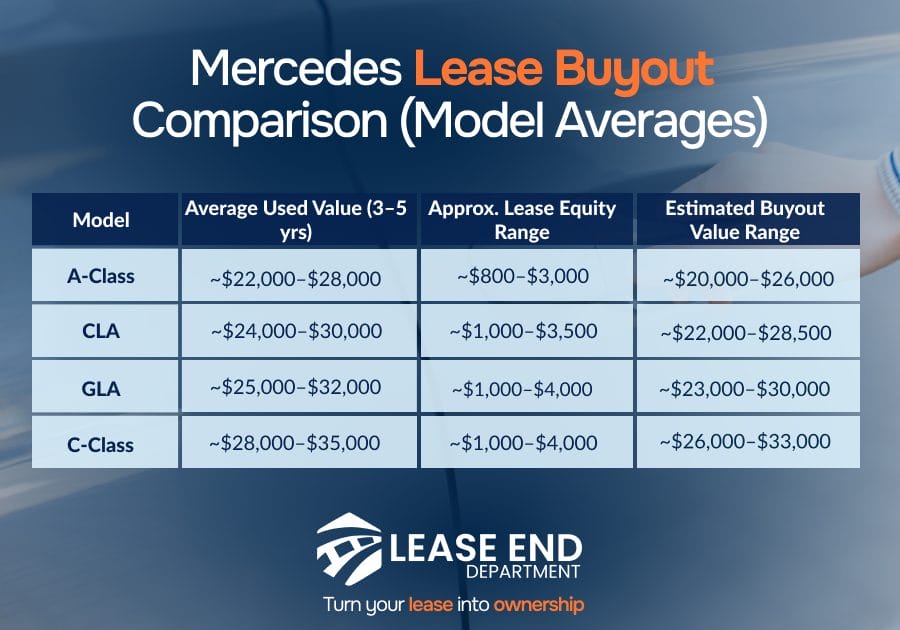

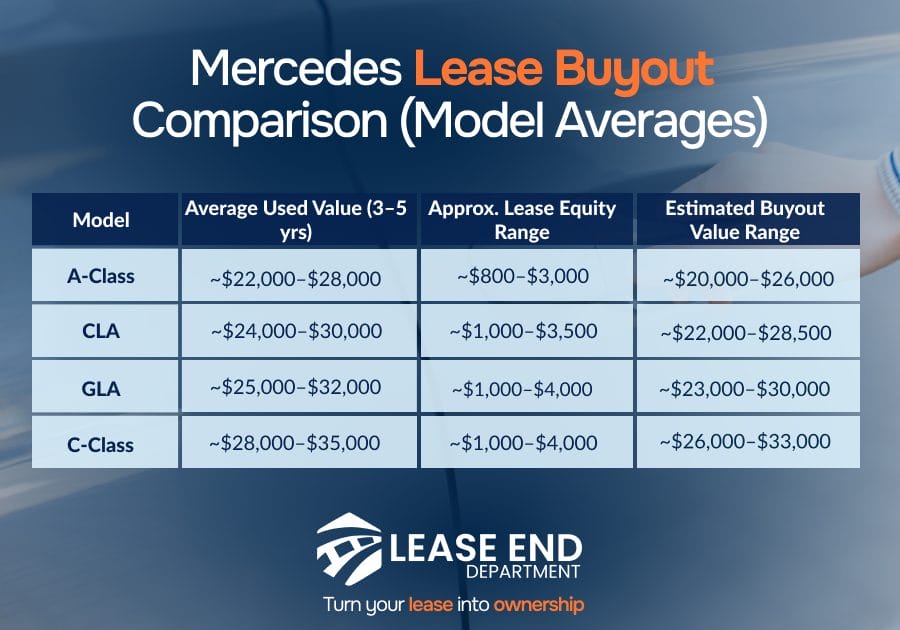

Real-World Examples by Model

Curious what a Mercedes lease buyout really costs? These real-world examples break down estimated buyouts across popular models

2020 Mercedes GLC 300

- MSRP: $50,000

- Residual: ~$27,000

- Estimated total buyout with fees/tax: $29,500–$30,300

2019 Mercedes E-Class Sedan

- MSRP: $59,000

- Residual: ~$30,000

- Estimated total buyout: $32,500–$34,000

2021 Mercedes GLE 350

- MSRP: $56,000

- Residual: ~$31,000

- Market value (used): ~$36,000

- Equity Opportunity: $5,000+ if you buy and refinance or sell a leased car

Mercedes-Benz Buyout Financing Options

Financing a luxury vehicle isn’t a one-size-fits-all proposition. Whether you’re paying upfront or stretching it over time, the way you finance your Mercedes lease buyout can impact your cash flow, loan flexibility, and long-term value.

Cash vs. Financing: What Fits You Best?

- Cash buyers avoid interest but may tie up capital that could be used elsewhere. For some, it’s peace of mind. For others, it’s unnecessary strain

- If writing a check feels like a gut punch, financing helps you breathe easier, and with today’s rates, many buyers find this the smarter move

Why MFS May Not Be Your Best Option

- Mercedes-Benz Financial Services (MFS) doesn’t always offer lease-end financing

- Even when they do, rates and flexibility may be limited

- Some lessees are encouraged to return the car rather than buy it, especially if they’re not financing through the dealership

Common Mercedes Lease Buyout Mistakes To Avoid

Avoiding these common mistakes could save you time, money, and frustration.

- Waiting too long to act: Lease-end pressure can limit your ability to compare financing or lock in the best deal

- Letting the dealership handle everything: This often leads to unnecessary markups, upsells, or limited financing options

- Not checking your car’s resale value: You might miss out on thousands in equity if your car’s market value exceeds your buyout price

- Skipping tax and fee calculations: Don’t assume your residual is the final price. Taxes, DMV fees, and lease charges can add $2,000 or more

- Ignoring warranty status: If your factory warranty has expired, budget for potential maintenance or consider a service contract

How Lease End Department Can Help With Your Mercedes-Benz Lease Buyout

When it’s time to decide whether to keep your Mercedes, you shouldn’t have to navigate paperwork, pricing, and pressure on your own. That’s where Lease End Department comes in.

Here’s what we bring to the table:

- Fast, online pre-approvals, so you can compare financing before your lease ends

- No dealership markups or hidden fees, just clear, customer-first numbers

- Full-service support, from title transfer to registration and even plate delivery

- 100% remote process, complete your buyout from home, on your time

You’ve already driven the car. You know it fits your life. Now, let us help you make it yours.

Besides Mercedes, we specialize in lease buyouts for many other popular brands, including:

CTA: Start your Mercedes-Benz lease buyout with Lease End Department today.

Mercedes-Benz Lease Buyout: FAQs

What is a Mercedes-Benz lease buyout?

A Mercedes-Benz lease buyout lets you purchase your leased vehicle at the end or, sometimes, during the lease term. You’ll pay the residual value plus sales tax, fees, and any remaining charges.

Can I negotiate my Mercedes lease buyout price?

Typically, the residual value in a Mercedes lease is non-negotiable since it was set in your original lease agreement. However, some third-party buyouts or early lease exits may leave room to negotiate fees or financing terms.

How do I get my Mercedes lease payoff quote?

You can request your payoff quote directly from Mercedes-Benz Financial Services online or by phone. The quote will include your residual value, purchase option fee, sales tax, and any remaining lease payments if applicable.

Is it better to return or buy my leased Mercedes?

If your vehicle’s market value is higher than your lease buyout price, or you want to avoid mileage or wear-and-tear fees, buying may be the better option. Always compare your payoff amount with your car’s resale value before deciding.

Does Mercedes-Benz Financial Services offer lease-end financing?

Not always. MFS doesn’t guarantee lease-end financing, which is why many lessees choose third-party options like Lease End Department for pre-approvals and better terms.

Can I buy out my Mercedes lease early?

Yes. Early lease buyouts are allowed in most Mercedes leases but may include remaining lease payments and an early termination fee. Check your lease agreement or contact MFS for the exact cost.

Do I have to go through a dealership to complete my buyout?

No. With Lease End Department, you can complete your entire lease buyout online, including financing, paperwork, title transfer, and registration without stepping into a dealership.