Yes, You Can Sell a Leased Car

- You can sell a leased car, but usually, you’ll need to buy it out first

- Start by getting your lease buyout quote and comparing it to your car’s value

- Lease sales can be made to dealers, private buyers, or online marketplaces after securing the title

- It’s critical to understand buyout terms, fees, taxes, and whether your lease allows early payoff or transfers

With used car prices still about 30% higher than pre-pandemic levels, many drivers are discovering an unexpected perk: their leased cars might be worth more than they owe.

And yes, you can sell a leased car that might just turn into a profit.

Here’s what we’ll cover:

- Whether your lease agreement allows you to sell your car

- How to calculate equity and compare your buyout price to market value

- Options for selling, trading in, or transferring your lease

- Common mistakes to avoid and how to simplify the process

What to Know When Selling a Leased Car

Terms for selling your leased car largely depend on your lease agreement and timing.

Most lease contracts include a buyout clause, which allows you to purchase the vehicle at a set residual value.

Once you own it, you can sell it to a dealer, a private buyer, or an online marketplace.

What Most Lease Contracts Allow

Most leasing companies give you two key options if you’re looking to sell.

These two options include:

- Buy then sell: You purchase the car from the leasing company at the residual value and then resell it.

- Third-party buyout: Some lenders allow a direct sale to a dealership or online buyer (like Carvana), skipping the need for you to buy it first. Not all companies permit this, so you’ll need to check.

When to Sell a Leased Car

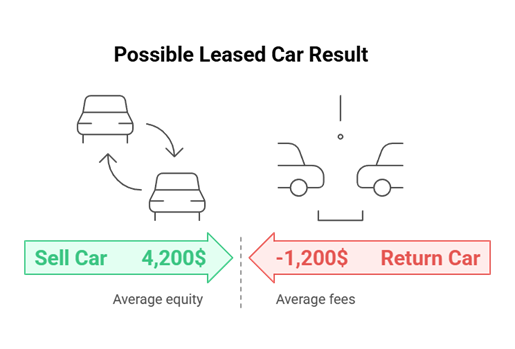

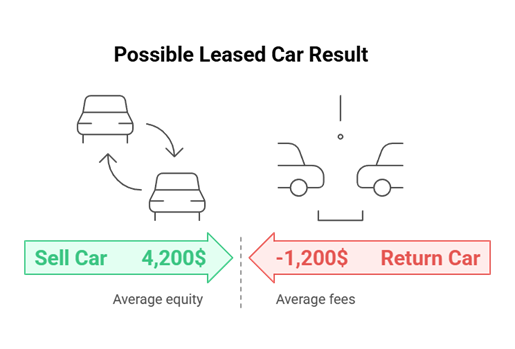

Selling a leased car can be a smart move if:

- The car’s market value is higher than the lease buyout amount. Say your payoff quote is $18,000, but your car’s market value is $22,000, that’s $4,000 in equity you could walk away

- You want to avoid excess wear, mileage, or turn-in fees

- Instead of returning the vehicle and paying penalties, selling could be cheaper, or even profitable

- You want to put the equity toward your next car

- The money earned from selling can help cover a down payment or reduce your loan on the next vehicle

How To Sell Your Leased Car

Here’s how to do it effectively while maximizing any equity you’ve built.

Step 1: Contact Your Leasing Company for a Buyout Quote

Start by requesting your official lease payoff or buyout amount.

The buyout quote should include:

- The residual value of the car (what it’s worth per the lease contract)

- Any remaining monthly payments (if you’re ending early)

- Taxes and fees required for transferring ownership

Watch for dealer markups. Some dealerships inflate this number, so go straight to the leasing company when possible.

Step 2: Check the Vehicle’s Current Market Value

Compare your buyout amount to what your car could sell for.

You can use some of these tools:

- Kelley Blue Book (KBB)

- Edmunds

- Carvana, CarMax, or Vroom appraisals

Example: If your payoff is $17,800 and your car’s market value is $20,500, you could walk away with $2,700 in equity.

Step 3: Explore Buyer Options

Once you know your equity, decide where to sell.

You have a few options, such as:

- Dealership trade-in: Quick and easy, especially if you’re leasing or financing a new vehicle.

- Private sale: May yield more money but involves handling the title and taxes yourself.

- Online platforms: Carvana, Vroom, and CarMax often offer quick quotes and even handle the paperwork.

Compare offers before committing, as some online buyers will match or beat competitors.

Step 4: Complete the Buyout and Transfer the Title

You’ll need to buy out the lease first (unless a third-party sale is allowed).

When you manage to buy out the lease, you should:

- Use your funds or financing to pay the leasing company

- Wait for the title to transfer to your name

- Finalize the sale to your buyer by signing over the title

Tip: Some lenders allow direct sales to third parties. Ask if your leasing company offers this to save time and title transfer steps.

Lease Buyout Before Selling

Selling a leased car almost always requires completing a lease buyout first.

A lease buyout is when you purchase your leased vehicle from the leasing company, either at the end of the lease or before it ends.

- Why it matters: You don’t legally own the car during the lease, so you can’t sell it without buying it first.

- Buyout price: Usually includes the residual value (agreed in the lease contract), plus remaining payments and fees if early.

- When it’s worth it: If the market value of your car is higher than the buyout amount, selling after a buyout can leave you with profit.

Example: Let’s say your buyout is $18,000 and the vehicle is valued at $21,000. After accounting for potential taxes or dealer fees, you could still net $3,000 in equity, especially if you act before market prices drop.

How To Finance a Buyout for a Profitable Sale

If you don’t have the cash upfront, you can still finance the buyout with:

- Lease-end financing: Use a lease buyout loan to cover the cost. Compare rates using your credit union, bank, or Lease End Department’s tools.

- Short-term loan strategy: Finance the buyout, then repay it quickly after the car is sold

- Using dealer incentives: If trading in, ask if they can help with the buyout directly

Tip: Getting pre-approved for a buyout loan in advance gives you more flexibility when it’s time to sell.

Common Pitfalls To Avoid When Selling a Leased Car

Not all lease buyouts are profitable, and you need to be aware of hidden costs such as:

- Early termination fees: Check your lease contract for penalties if buying before the end of term

- Sales tax: Some states require you to pay tax when buying out the lease before reselling

- Market fluctuations: Used car values shift quickly. Lock in your sale price before committing to the buyout

Don’t assume you’re getting equity without comparing the buyout to real-time appraisals.

Is Selling Your Leased Car the Right Move?

Selling your leased vehicle can be a smart financial decision, but only in the right circumstances.

When selling makes sense:

- Positive equity: If your car’s market value is higher than the lease buyout price, selling can put cash in your pocket.

- You no longer need the car: Lifestyle changes, relocation, or remote work might make your current lease unnecessary.

- Used car demand is high: In a tight market, dealers and buyers may pay more than expected.

When to reconsider:

- You’re near the lease end: Sometimes it’s easier to return the car or buy it for yourself.

- Negative equity: If your car is worth less than the buyout, you’d take a loss by selling.

- Contract restrictions: Your contract includes early payoff penalties or strict conditions.

Pro tip: Use online appraisal tools (like Edmunds or Carvana) to estimate your car’s resale value and compare it to your lease payoff. If there’s a gap in your favor, it might be time to sell.

How Lease End Department Can Help With Selling a Leased Car

If you’re considering selling your leased car, the process can feel overwhelming, especially when it involves buyouts, title transfers, and financial decisions.

That’s where Lease End Department steps in.

We help simplify the steps so you can sell your leased car with confidence and potentially walk away with equity in your pocket.

Here’s how we’re able to support you:

- Get a fast buyout quote: We request and review your lease payoff amount and help determine if selling is a smart move.

- Explore financing options: If you need a loan to complete your buyout, we offer pre-approval tools and access to competitive rates.

- Handle paperwork and DMV coordination: From title transfer to taxes, we manage the details so you don’t have to.

- Provide expert guidance: Our team walks you through every option, whether that’s buying, selling, or keeping your car.