How To Lease a Car: Key Points

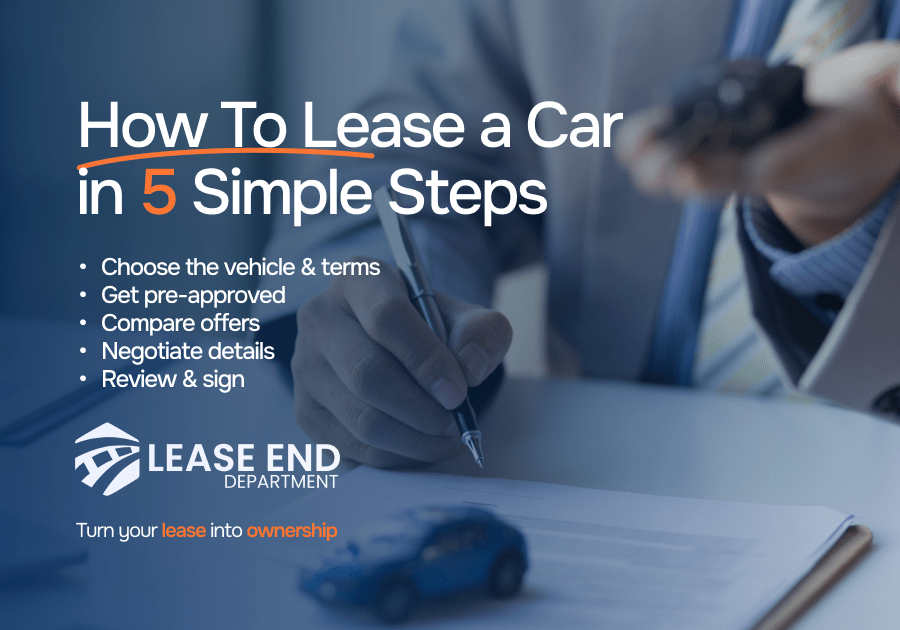

- Leasing a car involves choosing your vehicle, getting pre-approved, comparing deals, negotiating terms, and signing the agreement

- Leasing is ideal for drivers who want lower monthly payments, drive new models, and have short-term flexibility without a long-term financial commitment

- Most leases include mileage limits and wear-and-tear guidelines, so it’s important to align your contract with your driving habits

- Getting pre-approved and comparing offers helps you find the best deal and avoid hidden fees

- Many drivers don’t realize they can buy out their lease at the end of the term, potentially keeping the car for less than market value

Leasing is more popular than ever. In fact, nearly one in four new vehicles in the U.S. are leased rather than purchased, and among luxury cars, over 50% are leased.

If you’re considering your first lease, don’t panic, as navigating the process for the first time can be confusing.

This guide breaks down everything you need to know before signing a lease, including:

- How leasing works and how it compares to buying

- What to consider before getting started

- A step-by-step walkthrough of the leasing process

- Common mistakes first-time leasers should avoid

Complete Process of Leasing a Car

Leasing a car might seem overwhelming at first, but once you break it down, it’s a clear and straightforward process.

Here are the key steps to follow if you’re leasing a car for the first time.

Step 1: Research Vehicles and Lease Terms

Start by choosing the type of vehicle that fits your lifestyle and budget. The leasing terms for compact cars, SUVs, and electric vehicles vary significantly.

Look for models with strong residual value (the car’s estimated worth at the end of the lease), as this typically leads to lower monthly payments.

Then, familiarize yourself with typical lease terms:

- Lease length: Most leases run for 24 to 36 months

- Annual mileage limits: Common options are 10,000, 12,000, or 15,000 miles

- Down payment: Also called “capitalized cost reduction,” this can reduce your monthly cost but isn’t always required

Pro tip: Cars that hold their value better tend to lease for less because depreciation is a smaller part of the cost.

Step 2: Get Pre-Approved for Leasing

Pre-approval gives you a realistic view of what you can afford and helps you avoid surprises later in the process.

Leasing companies typically evaluate:

- Your credit score (ideally 680 or higher for good terms)

- Your income and debt-to-income ratio

- Any past leasing or financing history

Getting pre-approved helps with negotiation and speeds up paperwork when you’re ready to sign.

Try this: Use Lease End Department’s pre-approval tool to see what terms you may qualify for before going to the dealership.

Step 3: Compare Lease Offers and Incentives

Lease offers vary widely depending on the vehicle, dealership, location, and time of year.

Compare:

- Monthly payments

- Money factor (the leasing equivalent of an interest rate)

- Residual value

- Upfront fees like acquisition and disposition charges

Also, look for manufacturer lease incentives or specials, especially at the end of the model year.

Watch for fine print: Some deals advertise low payments but require a large down payment or have strict mileage limits.

Step 4: Negotiate Terms, Mileage, and Fees

Yes, you can negotiate a lease.

Focus on:

- The capitalized cost (the vehicle’s negotiated price)

- Mileage allowance: If you drive a lot, request a higher limit upfront to avoid excess mileage charges later

- Ask if acquisition, disposition, and documentation fees can be waived or reduced

Important: Make sure any agreed-upon changes are written into the lease contract before signing.

Step 5: Review and Sign Your Lease Agreement

Before signing, take your time reviewing the lease contract.

Double-check:

- Total monthly cost and due-at-signing amount

- Mileage limits and overage penalties

- End-of-lease terms, including early termination fees

- Whether a buyout option is included and how it’s calculated

Once you’re confident the terms match what you agreed to, sign the lease and make sure you get a copy for your records.

Helpful tool: Use the Lease End Department payment calculator to get a realistic idea of what your lease might cost each month.

What To Consider Before Leasing a Car

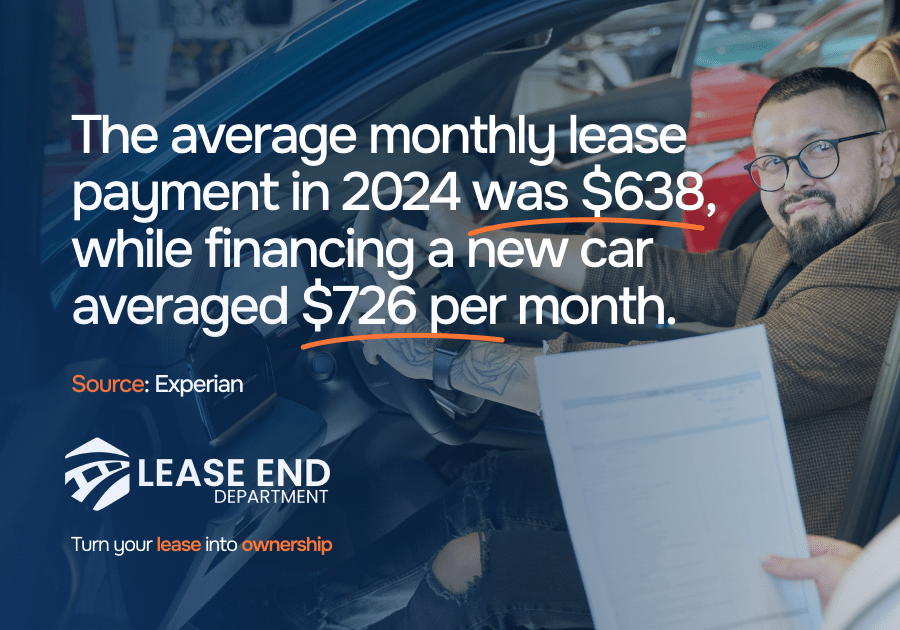

Leasing can be a smart way to drive a new car with lower monthly payments, but it’s not the right fit for everyone.

Before you go for it, consider these key factors:

- Your monthly budget: Leasing typically comes with lower payments compared to financing, but you’ll also need to account for insurance, upfront costs, and possible lease-end fees. Use a payment calculator to get a realistic estimate of what you can afford.

- How much you drive: Most lease agreements include annual mileage limits between 10,000 and 15,000 miles. If you exceed those limits, you’ll be charged for each additional mile, which can add up quickly.

- Wear and tear expectations: Leased vehicles must be returned in good condition. If you frequently travel with kids, pets, or gear, or if you’re rougher on your vehicles, you may face extra charges for excess wear.

- Long-term goals: Think about whether you’ll want to keep the car at the end of the lease. If you do, ask about a buyout option. This can give you an affordable path to ownership without paying full price upfront.

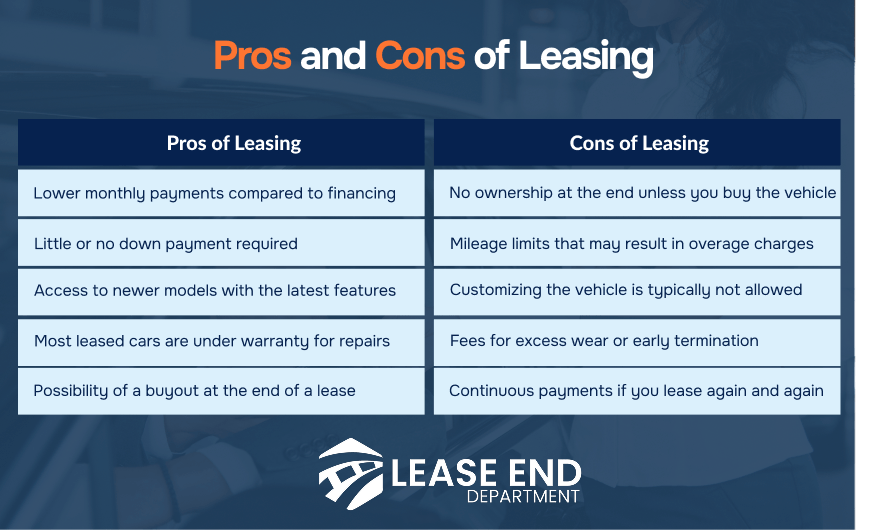

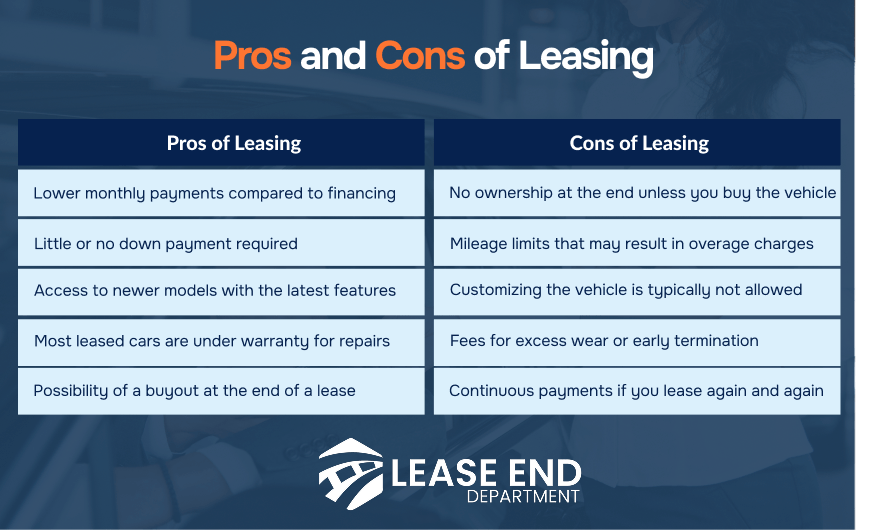

Pros and Cons of Leasing a Car

Leasing has its advantages and drawbacks depending on your financial goals, driving habits, and long-term plans.

Use the table below to quickly compare the pros and cons before deciding if leasing is the right path for you.

Common Mistakes To Avoid When Leasing a Car

Even if leasing sounds straightforward, there are a few common missteps that can lead to unexpected costs or missed opportunities.

Here’s what to watch for:

1. Don’t Ignore the Full Cost of the Lease

Many people focus only on the monthly payment and overlook other important factors. Watch out for high upfront fees, acquisition charges, and penalties buried in the fine print.

Always calculate the total cost of the lease, not just what you’ll pay each month.

2. Be Realistic About Your Driving Habits

Leases come with annual mileage caps, commonly 10,000 to 15,000 miles. If you drive more than that, you’ll pay for every extra mile, often 15 to 25 cents each. For example, driving just 5,000 miles over could cost you $750–$1,250 at lease-end.

- If you commute long distances, take road trips, or drive for work, this adds up quickly

- While you can sometimes buy additional miles upfront at a discounted rate, it must be done before signing

3. Consider Buyout Options and End-of-Lease Fees

Many drivers don’t realize they can purchase their leased car at the end of the term. If you like the vehicle, a lease buyout might be a better long-term investment than starting a new lease.

Also, be aware of potential lease-end fees for wear and tear, which can surprise you if you’re not prepared.

Real-life example: One driver on Reddit secured their lease buyout early by requesting paperwork just days after signing. They reviewed the residual value listed in their contract, secured outside financing with a competitive rate, and avoided dealership markups. With DMV paperwork handled by the lender, the entire process was smooth, and they kept the car they already loved, all while saving money in the long run.

How To Lease a Car: Key Takeaways

- Leasing is a beginner-friendly option that offers lower upfront costs and access to newer cars.

- Before leasing, consider your budget, how much you drive, and whether ownership might be a goal later.

- Following a structured, step-by-step process makes leasing less stressful and helps you avoid common mistakes.

- Lease buyouts offer flexibility and can be a cost-effective way to transition from leasing to ownership.

How To Lease a Car: FAQs

If we haven’t answered all of your questions above, here are some additional answers you might find useful.

How do you lease a car for the first time?

Start by choosing a vehicle, checking your credit, and getting pre-approved. Then compare lease offers, review the contract carefully, and make sure the monthly cost, mileage allowance, and end-of-lease options fit your needs.

Is leasing better than buying for beginners?

It can be. Leasing compared to buying usually means lower monthly payments and less responsibility for maintenance. It’s a good option if you want a newer car without a long-term commitment. Just make sure you understand mileage limits and lease-end costs.

What credit score is needed to lease a car?

Most leasing companies look for a credit score of at least 680, though higher scores often qualify for better terms. If your score is lower, you may still qualify but could face higher payments or a required down payment.

Can I buy my leased car at the end of the term?

Yes. Many lease agreements include a buyout option, allowing you to purchase the car for a set amount. This can be a smart move if the car is in good shape and still meets your needs.

What are lease acquisition and disposition fees?

An acquisition fee is a one-time charge to start the lease, while a disposition fee is charged when you return the car at the end. These fees vary by lender, so check your contract carefully.