Lease Buyout Loan Rates: Key Points

- Lease buyout loan rates typically range between 5.5% and 10.5% in 2025, depending on your credit, loan term, and lender

- Your credit score, vehicle condition, and loan term length play a big role in determining your final APR

- Shorter loan terms and strong credit usually lead to the lowest lease interest rates and overall cost

- Buyout loans are similar to used car loans, but dealership financing may come with higher markups and fewer flexible options

If your lease is ending and you love your car, you’re not alone. Thousands of drivers are choosing to buy out their leased vehicles instead of returning them.

While inflation is still pumping up the prices of new cars, a lease buyout can be a smart financial move, but only if you understand how lease buyout loan rates work.

In this guide, we’ll cover:

- What lease buyout loan rates are and how they’re calculated

- The current lease interest rates for buyout loans in 2025

- Key factors that affect your loan rate, including credit score and vehicle value

- Tips to qualify for the lowest possible rate

What It Costs To Keep Your Car Through a Lease Buyout Loan

Before signing any buyout documentation, it’s important to understand how much it will actually cost to keep your vehicle, and that starts with your lease buyout loan rate.

Your total cost will depend on:

- Buyout amount (usually the residual value stated in your lease)

- Loan term (how many months you want to finance)

- Interest rate (APR) based on your credit, income, and lender

- Taxes and fees, which may be rolled into the loan or paid upfront

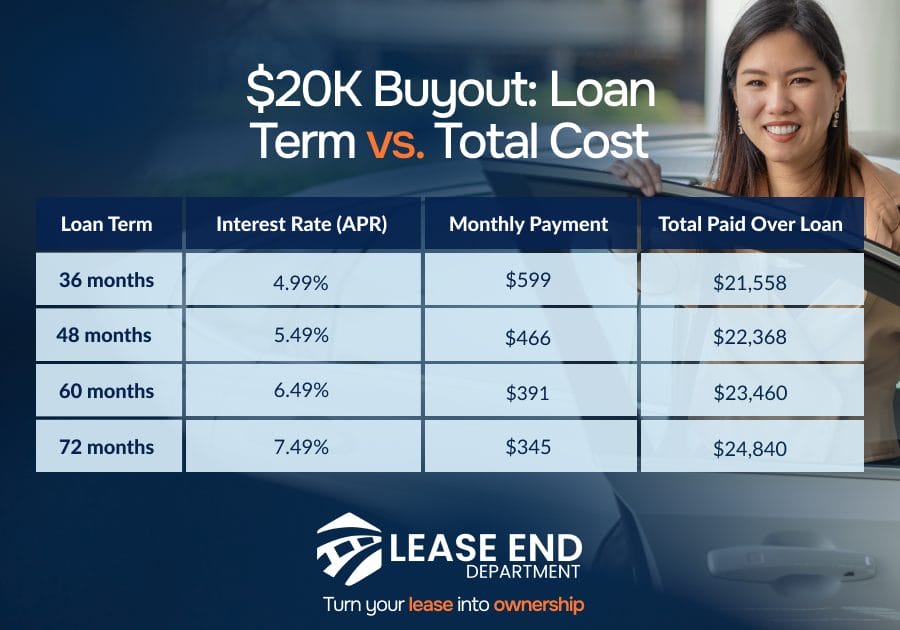

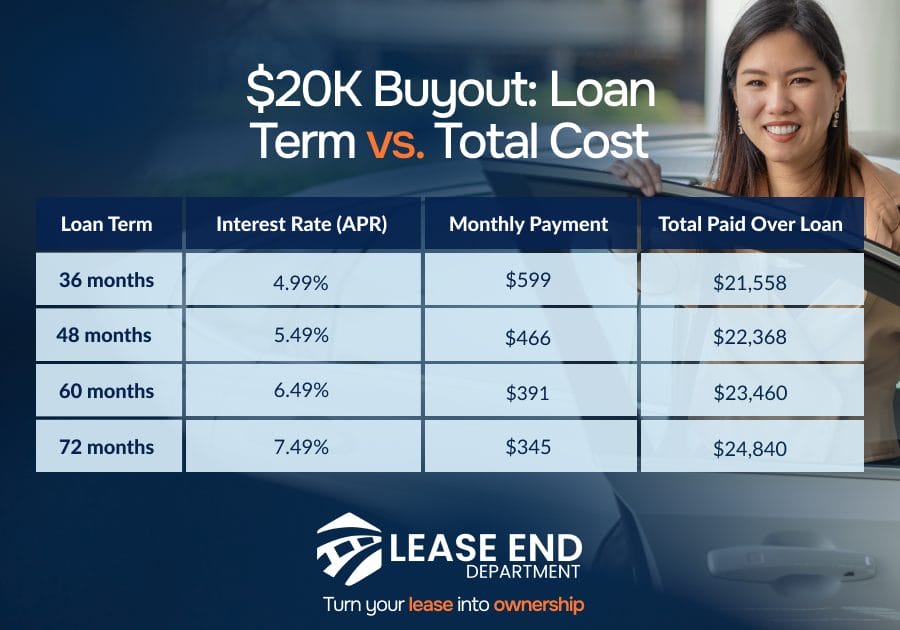

Below is a sample comparison based on a $20,000 lease buyout amount to show how different interest rates and loan terms affect your monthly payment and total cost:

Current Lease Buyout Rates For Loans in 2025

Lease buyout loan rates in 2025 are influenced by various factors, including credit scores, loan terms, and prevailing economic conditions.

How Current Auto Market Conditions Affect Buyout Rates

Several market dynamics are impacting lease buyout interest rates in 2025:

- Federal Reserve policies: The Federal Reserve’s interest rate decisions directly influence auto loan rates. While recent cuts aim to stimulate borrowing, the effect on auto loan rates may be gradual.

- Used car market trends: Stabilizing used car prices have led to adjustments in loan valuations, affecting the residual values and, consequently, the buyout amounts.

- Lender competition: Banks, credit unions, and online lenders are offering competitive rates to attract borrowers, providing opportunities for consumers to secure favorable terms.

According to a 2025 analysis by Investopedia, Bank of America, Consumers Credit Union, and First Tech FCU rank among the top lenders for auto loans with competitive rates and flexible terms ideal for lease buyouts.

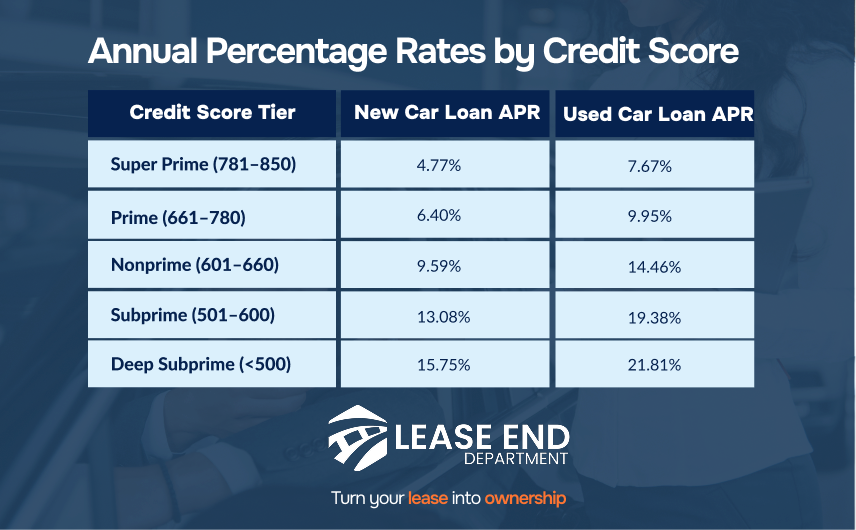

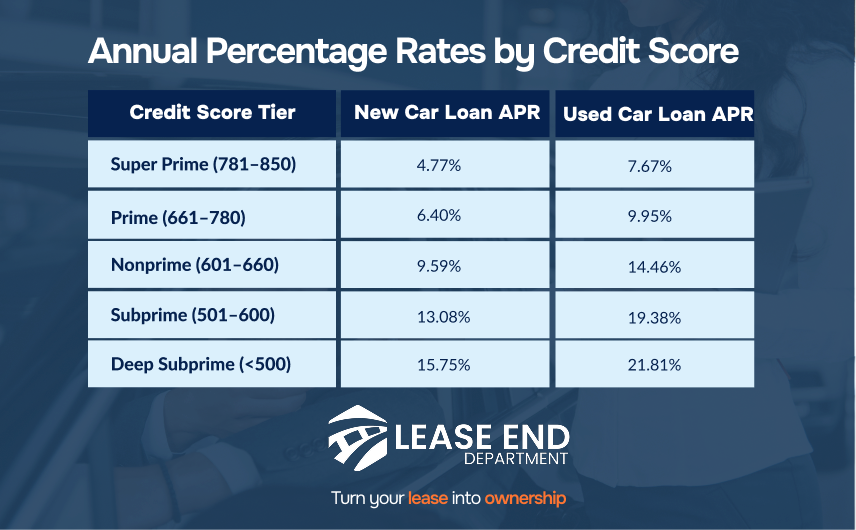

National Averages for Auto Loan APRs

Interest rates for auto loans vary based on creditworthiness and whether the vehicle is new or used.

Here’s a snapshot of average annual percentage rates (APRs) by credit score tier:

Lease buyout loans typically align with used car loan rates, given the vehicle’s pre-owned status at the end of the lease term.

Key Factors That Influence Your Buyout Loan Rate

When you’re financing a lease buyout or just learning how to lease a car, your interest rate isn’t just a number; it’s a reflection of multiple financial and vehicle-specific factors. Understanding what affects your rate helps you identify where you can improve and where to shop for the best loan terms.

Credit Score and History

Your credit score is one of the biggest drivers of your lease buyout loan rate. Lenders use it to assess your reliability as a borrower.

- A score above 720 often qualifies for rates under 6%

- Scores below 660 may push you into the 9%–12% range

- Missed payments or high credit utilization can raise your rate

Tip: If your score has improved since your lease started, you may qualify for a much lower rate than the one used in your original lease contract.

2. Vehicle Condition and Mileage

Because the car is used, lenders evaluate its age, mileage, and condition before assigning a rate. The older or higher mileage your vehicle is, the more “risk” a lender assumes.

- Vehicles under 5 years old typically qualify for better rates

- Lower mileage means less depreciation and lower perceived risk

3. Loan Term and Structure

The length of your loan impacts your rate and total cost:

- Shorter terms (36–48 months) usually offer lower APRs

- Longer terms (60–72 months) come with higher interest but lower monthly payments

Example: A 60-month loan at 7.9% may save you monthly, but you’ll pay more over time than a 48-month loan at 6.2%.

4. Lender Type

Not all lenders offer the same rates or flexibility:

- Credit unions tend to offer the lowest lease buyout loan rates

- Online lenders are convenient and competitive but may include more fees

- Dealerships often add markups to rates, especially on buyouts

Tip: Use a pre-approval tool like Lease End Department’s application to check your rate with minimal hassle.

Tips to Qualify for the Lowest Lease Buyout Loan Rates

Want a better rate on your lease buyout loan?

These quick tips can help lower your APR and total cost:

- Boost your credit score: Pay off debts, fix credit report issues, and avoid opening new accounts before applying. A score above 700 can unlock better terms.

- Compare lenders: Rates vary widely. Look at credit unions, banks, online lenders, and use Lease End Department’s pre-approval tool to find the best fit.

- Choose a shorter loan term: Shorter terms (36–48 months) often come with lower interest rates.

- Keep your car in good condition: Low mileage and no major damage can work in your favor with lenders.

- Make a down payment: Even a small amount upfront can lower your interest and reduce your monthly payment.

Lease Buyout Loan Rates: Key Takeaways

- The interest rate you qualify for can significantly impact your total lease buyout cost.

- Comparing offers, improving your credit, and using a trusted financing partner can save you thousands over the life of your loan.

- Lease End Department simplifies the process by helping you lock in a great rate and handle all buyout logistics.

- If your car’s residual value is lower than its market price, buying out your lease can be a financially smart move, especially with the right loan.

How Lease End Department Helps You Finance Your Buyout

If you’re ready to keep your leased car, Lease End Department makes the buyout process simple, affordable, and stress-free.

Instead of navigating rates and paperwork on your own or relying on dealership markups, you get expert support from a team that specializes in helping drivers transition from leasing to ownership.

If you ride with us, you’ll get:

- Personalized loan options: You’ll receive financing recommendations tailored to your credit, budget, and timeline, often with lower rates than dealership offers.

- Fast pre-approval: Use Lease End Department’s pre-approval tool to quickly see what loan terms you qualify for.

- No dealership pressure: You avoid upselling tactics and extra fees that come with going through the dealership directly.

- Full-service paperwork: From title transfer to DMV registration, Lease End Department handles the logistics for you.

- Transparent pricing: You get a clear breakdown of your loan, payments, and interest with no surprise charges.

Bonus tip: Use the payment calculator to estimate your monthly cost and plan ahead before committing.