Leasing vs. Buying a Car: Key Points

- Leasing gives you lower monthly payments, access to new models, and short-term flexibility, but with a smart buyout with the right lease partner, it can also lead to affordable long-term ownership

- Buying builds equity over time, eliminates mileage limits, and saves more long term, though it typically requires higher upfront costs

- New vehicle prices are up 20% since 2020, so locking in a favorable lease or buying out an existing one can protect against further inflation

- Leasing is ideal for drivers who want low payments and frequent upgrades, while buying is usually better for the ones who have a better upfront budget

Over 20% of new vehicle transactions in the U.S. are leases, proving that drivers are actively weighing the pros and cons of leasing versus buying every day.

If you’re not sure whether to buy or lease your next car, our guide provides more on:

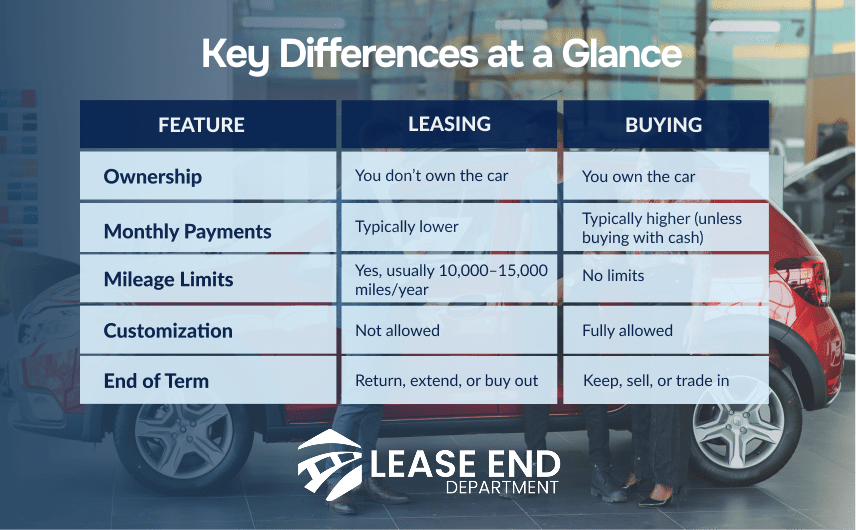

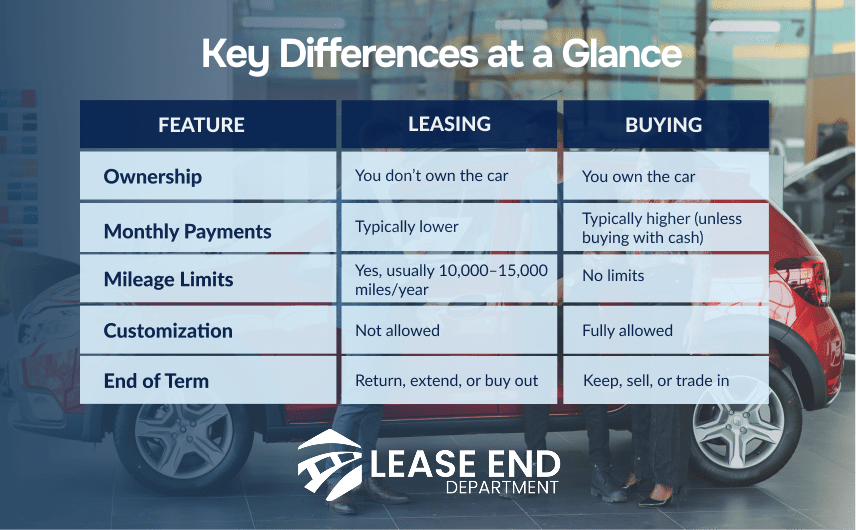

- The main differences between leasing and buying

- Why buying out a leased car is a good option

- Key pros and cons of each option

- How your driving habits and budget influence the decision

- Long-term financial outcomes to consider

What’s the Difference Between Leasing a Car vs. Buying?

Let’s break down how each option works and what sets them apart.

Leasing: Lower Payments Now, Transition to Ownership Later

Leasing is similar to renting or paying monthly credit card obligations. You make monthly payments to use the car for a set time, usually two to three years. When the lease ends, you return the vehicle or choose to purchase it through a lease buyout.

Leasing is a better option if you:

- Want lower monthly payments and little to no upfront cost

- Prefer driving a newer model every few years

- Do not mind mileage restrictions or wear-and-tear guidelines

- Want flexibility now, with the option to own the car later through a lease buyout

If you have the right lease partner, a buyout at the end of your lease means that you can own a car that you already know and trust.

Buying: Full Ownership if You Have the Budget

Buying a car gives you full ownership once it is paid off, whether you finance it or pay in cash. When you purchase the car fully, you have the complete freedom to do anything you’d like with it.

Buying might be the better choice if you:

- Plan to keep your car for several years

- Drive long distances or commute frequently

- Want to build long-term value through ownership

- Prefer not to deal with lease-end inspections or return fees

Although buying often comes with higher monthly payments, it can save you money over time once the loan is paid off.

How To Maximize Savings: Leasing vs. Buying

Are you interested in lower monthly payments now or ownership value later? The answer to this question strongly depends on how long you plan to keep the car.

The average monthly lease payment in the U.S. is $638, compared to $726 for a financed new car, making leasing an attractive option for budget-conscious drivers.

Let’s look at three common driver scenarios and how the savings compare:

Scenario 1: You’re a Short-Term Driver Who Upgrades Frequently

Best option: Leasing only

- You drive less than 12,000 miles per year

- You’re looking for a new vehicle every 2 to 3 years

- You prioritize lower monthly payments and don’t plan to keep the car

Leasing saves roughly $5,000–$7,000 over 3 years vs. financing a new car.

Scenario 2: You’re a Budget-Conscious Driver Who Might Want to Own Later

Best option: Lease with a buyout

- You want low payments now, but may want to keep the vehicle

- You’re open to ownership without large upfront costs

- You prefer to avoid dealership pressure at lease-end

Lease + buyout can save $2,000–$3,000 compared to buying new upfront, with more flexibility.

Scenario 3: You’re a Long-Term Owner with Stable Finances

Best option: Buying upfront (finance or cash)

- You drive over 15,000 miles per year

- You plan to keep the vehicle 6–10 years

- You have the budget for higher payments or a down payment

Buying provides the best long-term value and full ownership equity.

Example: 5-Year Cost Comparison: Lease with Buyout vs. Buying New

Let’s compare three scenarios for the same car (MSRP: $30,000):

| Scenario | Lease then Buyout | Buy New (Finance) |

| Lease term | 3 years | N/A |

| Monthly lease payment | $450 | N/A |

| Buyout price after 3 years | $18,000 | N/A |

| Monthly loan payment (buyout) | $430 (2 years) | $575 (5 years) |

| Down payment | $2,000 | $4,000 |

| Total cost over 5 years | ~$32,000 | ~$34,500 |

Assumptions:

- The lease includes 12,000 miles/year

- A 5% interest rate on financing

- No excessive wear-and-tear or over-mileage fees

- The buyer keeps the car for 5 years in both cases

Pros and Cons of Leasing vs. Buying a Car

To make the best decision, it’s important to look beyond just monthly payments and consider factors like flexibility, ownership, and long-term costs.

Pros and Cons of Leasing a Car

Pros of leasing:

- Lower monthly payments compared to buying

- Little to no down payment required

- Access to newer cars with the latest features

- Most leased vehicles are under warranty, reducing repair costs

- Easy to upgrade to a new car every few years

Real-world example: One Civic driver on Reddit discovered their lease buyout cost was clearly stated in the contract at $14,943. The dealership tried to inflate their total payoff to over $33,000 by pushing a five-year loan.

With an excellent credit score, they realized they could finance the buyout more affordably elsewhere, avoiding dealer markups and saving thousands. This kind of situation is exactly why more drivers are choosing independent lease buyout services.

Cons of leasing:

- No ownership at the end of the term unless you buy it out

- Annual mileage limits, with penalties for going over

- Customization is not allowed

- Potential fees for excessive wear and tear

- Continuous cycle of car payments if you keep leasing

Pros and Cons of Buying a Car

Pros of buying:

- Full ownership once the loan is paid off

- No mileage restrictions or lease return fees

- Freedom to customize or modify your vehicle

- Long-term cost savings if you keep the car beyond the loan period

- You can sell or trade in the vehicle at any time

Cons of buying:

- Higher monthly payments compared to leasing

- Larger down payment may be required

- Vehicle value depreciates over time

- You are responsible for repairs after the warranty expires

Current Market Trends That Influence Leasing vs. Buying

Several factors are reshaping how drivers across the U.S. approach leasing and buying:

- Leasing is more common in urban and coastal areas, especially in states like California, New York, and Florida, where consumers prioritize flexibility and frequently drive newer models.

- Credit tier matters. Nearly 80% of new leases are written for prime or super-prime credit tiers. Buyers with excellent credit often receive better lease terms, making leasing and buyout an even more attractive option.

- Luxury vehicles are leased far more often than economy cars. In 2023, about 50% of luxury vehicles were leased, compared to less than 20% of economy models.

- Economic uncertainty is increasing lease appeal. With inflation and interest rates on the rise, many drivers are seeking short-term commitments with lower monthly costs and leaving open the option to buy out if financial conditions improve.

- Used vehicle values are still high. This means lease buyouts can offer a great deal, drivers may end up purchasing their car below current market value.

Should You Lease or Buy Based on Budget, Driving Habits, and Goals?

Your budget, how much you drive, and your long-term plans all play a major role in deciding whether leasing or buying is the better fit for your needs.

How Often Do You Like To Upgrade Your Vehicle?

Leasing makes sense if you prefer switching cars every few years to enjoy the latest technology and features without the commitment of ownership.

Pro tip: Choose leasing with a buyout option if you want flexibility now, but might decide to hold on to your vehicle later.

Do You Drive Long Distances or Keep Mileage Low?

Leases come with annual mileage limits, and exceeding them leads to extra fees. Buying is better if you drive a lot or want unlimited freedom.

Pro tip: If you drive more than 15,000 miles per year, buying is likely the more cost-effective choice.

Are You Looking To Build Equity or Prioritize Lower Monthly Payments?

Leasing typically offers lower monthly payments but doesn’t build ownership. Buying costs more upfront but gives you long-term value. A lease buyout can combine both benefits which mean lower payments up front, with the ability to turn your lease into full ownership later.

Pro tip: If you want affordable payments now and ownership later, leasing with a buyout plan may be your best option.

What’s Your Financial Outlook Over the Next Few Years?

If your income is steady, buying offers better long-term savings. If your situation is prone to change, leasing gives you short-term flexibility.

Pro tip: Lease if you need lower upfront costs now, but consider buying if your finances are stable and you want lasting value.

Leasing vs Buying a Car: Key Takeaways

- Leasing offers short-term flexibility and affordability but doesn’t result in ownership.

- Buying may cost more initially but pays off with long-term savings and equity.

- Consider how much you drive, how long you want to keep the car, and your financial outlook.

- Lease End Department helps you turn your lease into ownership with financing, paperwork, and title handling made easy.

How Lease End Department Helps You Transition from Leasing to Ownership

At Lease End Department, our team will help you with ending your lease and keeping your car.

Why are we so sure about that? Because we offer tailored financing and coverage options to fit your budget.

When you choose Lease End Department, you get:

- Straightforward financing support: We help you explore loan options tailored to your credit profile and monthly budget.

- Fast, online document handling: Review and sign your buyout paperwork from the comfort of home with overnight processing.

- Full title and registration services: We take care of the paperwork, so you skip the DMV and get your plates delivered to your door.

- Helpful tools and calculators: Use our payment calculator or get pre-approved in minutes to better understand your buyout costs.

- A smooth, customer-first experience: Thousands of drivers have already used our process to keep their cars and avoid the typical lease-end hassle.

- Local support you can trust: Based in Naples, FL, we proudly serve drivers across the region with personalized, one-on-one guidance.