Nissan Lease Buyout: Key Takeaways

- Love your Nissan? You can keep it. A lease buyout lets you skip the stress of shopping and stick with the car that already fits your life

- Your payoff price quote isn’t the whole story. Remember to factor in taxes, fees, and (if buying early) termination costs when deciding if the numbers work

- Your car might be worth more than you think. If the market value beats your buyout price, you’re holding equity and that could make buying a no-brainer

- Financing doesn’t have to be complicated. NMAC isn’t your only option. With Lease End Department, you can get pre-approved, compare your terms, and buy out your lease 100% online

- We will also take care of the nitty-gritty: title, plates, registration… the stuff no one wants to deal with. All you have to do is decide if your Nissan’s worth holding on to

You know the feeling. That quiet click of the door. The way the engine hums, familiar and steady. The routes you’ve memorized. The coffee spilled in the cupholder. The songs you’ve sung with the windows down.

This isn’t just a car. It’s your car.

So when the lease clock starts ticking down, you pause. You wonder: “Do I really want to give this up?”

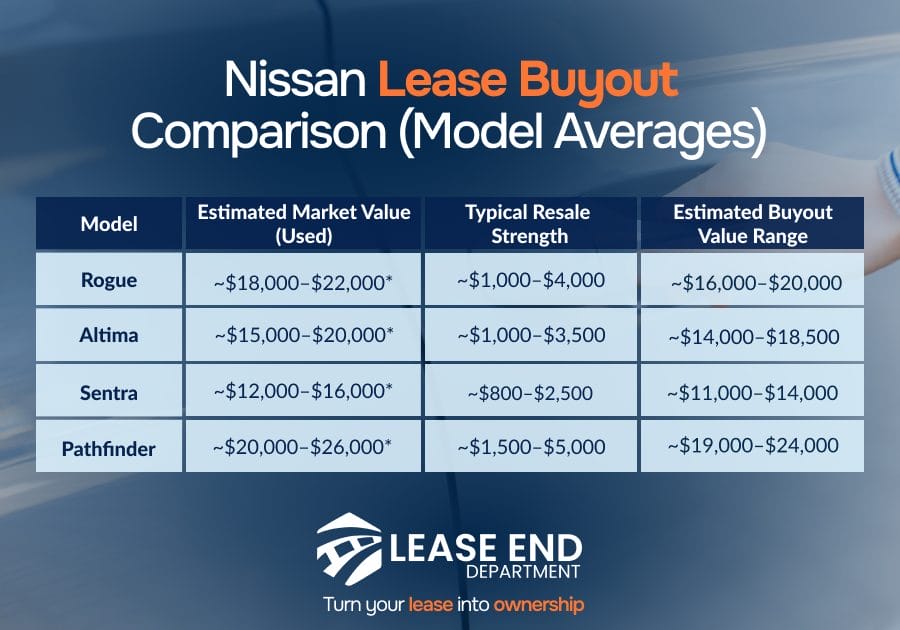

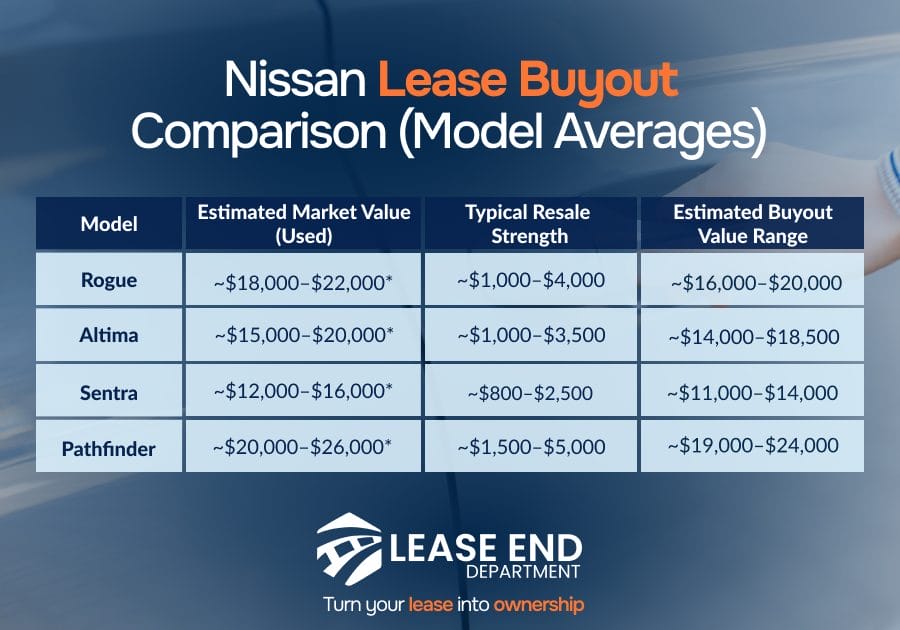

And then something unexpected enters the picture, something more practical than sentimental. Nissan vehicles hold their value. Especially the ones people actually want to drive: Rogue. Altima. Pathfinder.

In this guide, you’ll find:

- Everything you need to know about a Nissan lease buyout

- How much it costs

- How to calculate your payoff

- How to decide whether keeping your Nissan is the right choice for you

Nissan Lease Buyout: Key Facts

Before you decide to turn in your keys or make your Nissan yours for good, here are the key details you need to know: no fluff, just real value.

- You’re buying at a fixed price: When you first leased your Nissan, the contract included a set value for the car at the end, usually around half the original price. So if your Altima had a sticker price of $30K, your buyout might fall somewhere between $17,000 and $18,500

- The process is handled through Nissan Motor Acceptance Company (NMAC): That means you’ll request your payoff quote directly from them, not the dealership

- You can buy early, but it may cost more: Early buyouts can include remaining lease payments or a Nissan lease early termination fee. Check your car lease for exact terms. Early buyouts can make sense if your car is over-mileage or showing wear

- Market value matters: If your Nissan is worth more than the buyout amount, you’re sitting on equity. Example: A 2021 Nissan Rogue with a $19,000 buyout could be worth $22,000 today

- Popular Nissan models often retain value: The Rogue, Altima, Pathfinder, and Sentra tend to perform well in the resale market, giving you stronger buyout upside

- Buying avoids lease-end penalties: Bought the car? That means no more worrying about dings, scratches, or going over your mileage limit. And best of all, no awkward back-and-forth with a dealership trying to upsell you into a new lease

Lease Buyout Process in 5 Simple Steps

Converting your Nissan lease into ownership doesn’t have to be complicated. Follow these five steps to stay in control and avoid common pitfalls.

1. Request Your Payoff Quote From Nissan Motor Acceptance Company (NMAC)

Before anything else, get the actual number you’d need to buy your car. This sets the baseline for your decision-making.

What it typically includes:

- Your residual value, locked in at the start of your lease

- Sales tax, purchase option fee, and other costs

- Any remaining payments if you’re buying early

- Request directly from NMAC online or by phone, dealerships may add markups

Tip: Payoff quotes are usually good for 10 days. Request it at least 30–60 days before your lease ends to keep all options open.

2. Compare Your Payoff to Your Nissan’s Market Value

Just because you can buy your Nissan doesn’t mean you should. Don’t decide until you have run the numbers.

Here’s how to easily evaluate the buyout option:

- Head over to sites like Kelley Blue Book or Carvana and plug in your car’s info such as mileage, condition, and ZIP code

- If your car’s market value > buyout price, you have equity

- Equity can be used to refinance, trade in, or sell outright later

Tip: A 2021 Nissan Rogue with a $19,000 buyout and $22,000 market value gives you $3,000 in equity. That’s value you don’t want to miss.

3. Decide When To Buy: Now or Lease-End

When you buy affects what you pay and how much flexibility you have.

Here’s what to weigh:

- Early buyout may include lease payments and fees

- Lease-end buyout is cleaner but risks wear or mileage penalties

- Choose based on your Nissan’s condition and how close you are to lease maturity

Tip: If you’re over your mileage limit or have minor damage, an early buyout could actually save you money on lease-end penalties.

4. Choose How to Pay: Cash or Financing

You’ve got two main ways to pay: write a check for the whole amount or spread it out with a loan, just as you would for any used car. Most folks go with financing to keep their savings intact and payments manageable.

Before you choose cash or financing:

- Lease End Department offers fast, online buyout financing

- Compare rates with your bank or credit union

- Always include sales tax and DMV fees in your total estimate

Tip: A $20,000 buyout at 6.5% over 60 months is roughly $390/month. Pre-approval helps you budget before your lease ends.

5. Complete Paperwork and Take Ownership

Once you’ve committed, it’s time to handle the legal stuff and make it official.

Here’s what happens:

- Pay NMAC or your financing provider

- Transfer the title, complete registration, and pay local taxes/fees

- Lease End Department takes care of all paperwork and plate delivery, online and hassle-free

Tip: DMV paperwork errors are the #1 delay in buyout completions. Let LED handle it for you so you can enjoy your Nissan stress-free.

Nissan Lease Buyout Price: Costs and Fees Explained

When you buy out your leased Nissan, your total cost includes more than just the buyout price listed in your lease. Here’s a breakdown of what you’ll likely pay, plus an example to make it real.

- Residual value: This is the base of your buyout price, set when you signed your lease. For Nissans, it’s usually 50–60% of the original MSRP. Example: On a $30,000 vehicle, expect a residual value between $15,000 and $18,000.

- Sales tax: Most U.S. states charge 5–10% sales tax on the buyout amount. This can add a significant amount to your final cost. Check your state’s DMV site or ask LED for a quote with tax included.

- Purchase option fee: A flat fee charged by NMAC (or noted in your lease), typically $300–$400. It’s usually non-negotiable

- Title and registration fees: You’ll need to pay these to transfer ownership and get new plates. Most states charge $100–$300 depending on your location

Early Buyout Costs (if Applicable)

If you’re buying before lease-end, your payoff quote may also include:

- Remaining lease payments

- A Nissan early termination fee

- Possibly a small admin or disposition charge

Real-World Example: 2021 Nissan Rogue

Let’s say you’re driving a 2021 Nissan Rogue with an original MSRP of $30,000.

Here’s how the estimated buyout might look:

- Residual value: $17,400

- Sales tax (7%): $1,218

- Purchase option + fees: $400

- Estimated total: $19,000–$20,000

Financing Options for a Nissan Lease Buyout

You don’t have to pay your entire buyout cost in cash. Just like a used car purchase, financing your Nissan lease buyout is often the smarter move, especially if you want to keep monthly payments manageable.

Cash vs Financing: What’s Better?

- Paying cash can make sense if you have the savings and want to avoid interest

- Financing lets you spread out the cost over time, typically with terms from 36 to 72 months

- Most lessees choose financing, especially when rates are competitive and cash flow matters

Why Not Just Finance Through Nissan?

- Nissan Motor Acceptance Company (NMAC) doesn’t always offer lease-end financing

- Even when they do, the rates may not be as competitive or flexible as third-party lenders

- Some drivers are told to return the vehicle instead of finance it, which limits your options

How Lease End Department Can Help With Your Buyout

When your lease ends, dealerships want to get you into something new. But if you’d rather keep the Nissan you already trust, Lease End Department is here to help you do just that, without the pressure, paperwork headaches, or hidden fees.

Here’s what we do for you:

- Request your official payoff quote directly from NMAC, so you’re working with real numbers

- Offer fast, no-pressure financing tailored to your credit and your budget

- Handle all the paperwork, from title transfer to registration and plate delivery

- Keep it 100% online, so you can complete your lease buyout from home, no dealership visits required

- Support you with real humans, not sales scripts or bots

Whether you’re ready to buy now or just want to explore your options, our job is simple: make your Nissan lease buyout easy, transparent, and fully in your control.

Besides Chrysler, we also specialize in lease buyouts for popular brands, including:

Nissan Lease Buyout: FAQs

Still not sure about the potential lease buyout? Here are some questions & answers that might be useful.

What is a Nissan lease buyout?

A Nissan lease buyout lets you purchase your leased vehicle, usually at the end of your lease, by paying the residual value plus sales tax and fees. It gives you the option to own the car instead of returning it.

Can I buy my Nissan before the lease ends?

Yes. Most Nissan leases allow for an early buyout, though you may be required to pay remaining lease payments and an early termination fee. Always check your lease agreement or request a payoff quote from Nissan Motor Acceptance Company (NMAC).

How do I get my Nissan lease payoff quote?

You can request your payoff amount directly from NMAC online or by phone. This quote includes the residual value, sales tax, and any applicable fees.

Is it worth it to buy my leased Nissan?

It depends on your car’s current market value. If the value of your Nissan is higher than your lease buyout price, buying it could give you equity and save you money compared to starting a new lease or purchase.

Does NMAC offer financing for lease buyouts?

Not always. Nissan Motor Acceptance Company doesn’t guarantee lease-end financing. That’s why many lessees use third-party lenders like Lease End Department for flexible, transparent financing options.

Can I avoid the dealership when buying out my lease?

Absolutely. If the dealership vibe isn’t your thing, you can handle the entire buyout online with us, from the payoff quote to getting your new plates in the mail.

What costs are involved in a Nissan lease buyout?

In addition to the residual value, expect to pay sales tax (5–10%), a purchase option fee (usually $300-$400), title and registration fees, and possibly early termination charges if you’re buying out early.