What Happens If You Damage a Leased Car: Key Takeaways

- Most leasing companies allow small chips, light tire wear, and minor upholstery stains under “normal wear and tear”

- Large dents, broken parts, or torn interiors could cost you $100s unless repaired before turn-in

- You always have three options: repair the damage, buy out the lease, or negotiate at lease-end

- Insurance may cover repairs, but you’ll need to report damage and cover the deductible or costs not included in your policy

- Independent shops can handle repairs affordably, just make sure the work meets lease return standards

- If your car’s in rough shape, buying it out might be cheaper than paying for repairs and return fees

Accidentally dinged your leased car, or just noticed a mysterious scratch before turn-in day?

Don’t panic. You’re not the first (or the last) lessee to stress over lease-end damage.

The truth is, a few scuffs and scrapes are expected. But knowing what’s considered normal wear and what could cost you hundreds can make or break your lease return experience.

This guide breaks it all down:

- What happens if you damage a leased car

- Acceptable damage and inspection tips to

- Fees you might pay

- Additional tips for various scenarios

What Happens If You Damage a Leased Car?

So, you scraped a bumper. Or maybe there’s a mysterious ding you swear wasn’t there last week.

Don’t worry, this stuff happens. Leasing companies aren’t expecting a showroom floor return.

But, there’s a fine line between what’s “normal” and what’s going to cost you.

This is where the fine print comes alive; with a checklist more detailed than you bargained for.

It includes:

- Excess wear and tear that goes beyond what’s considered typical use

- Exterior or interior damage like dents, cracked windshields, or torn upholstery

- Unreported accidents or repairs not handled through insurance

If the inspector flags something as damage (and not just wear), you’ll likely be charged for it, unless you repair it beforehand or opt for a lease buyout. The good news? You’ve got options, and we’ll walk you through all of them.

Acceptable Damage on a Leased Car: What’s Covered

It’s totally normal for a leased car to show a bit of personality by the end of its term. Small signs of everyday use are expected, and most leasing companies won’t charge you for those, as long as they’re not over the line.

Here’s the difference between what qualifies as normal and what goes too far.

Normal Wear and Tear (Usually No Extra Charges)

Stuff that won’t raise eyebrows? Usually things like:

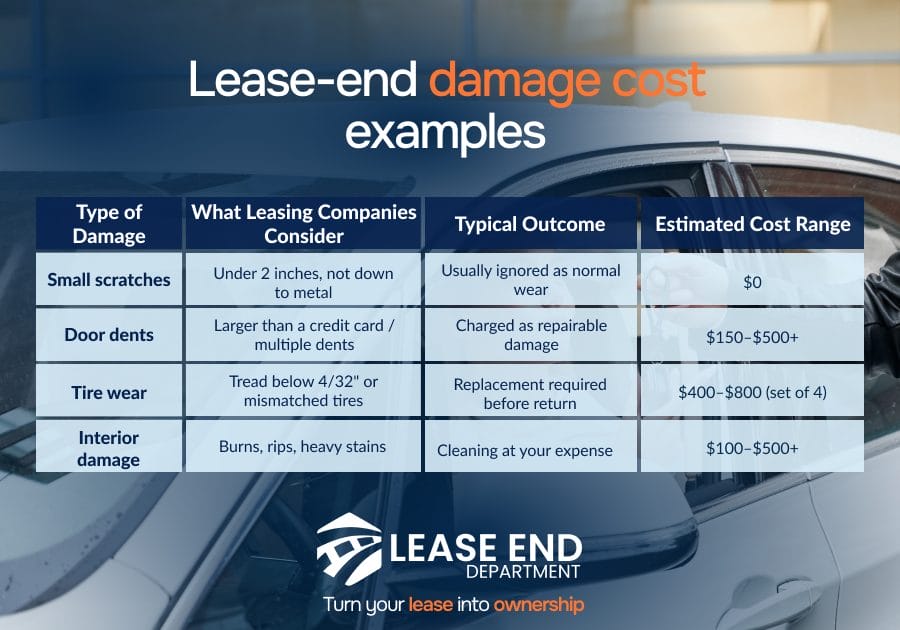

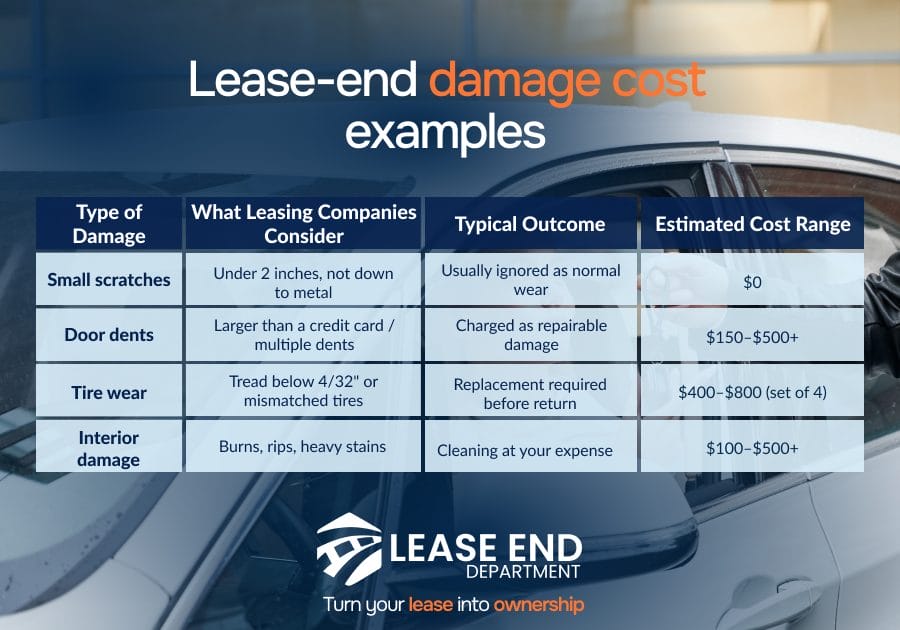

- Small paint chips, tiny scratches, and minor dings, under 2 inches and without major paint loss are acceptable.

- Light interior wear, like faint seat creases or gently scuffed plastic trim, this is part of everyday use.

- Mechanical wear due to regular driving, such as brake pad thinning, tire tread wear, or general aging of components in working order.

When Wear Becomes Excessive (Potential Lease-End Charges Apply)

Some issues go beyond everyday wear and can trigger fees.

Watch out for:

- Denting) larger than a few inches or deep enough to break the paint, or when there are multiple dings in the same area.

- Tire or wheel damage, such as worn-out treads below 4/32″, mismatched tires, or damaged rims.

- Interior damage such as tears, burns, or nasty stains, or faded upholstery that looks more than just aged.

- Cracked or chipped glass, especially if in the driver’s line of sight or beyond a minor “star fragment”.

- Missing parts, structural damage, or mechanical issues from neglect, could land you with extra charges

Returning a Leased Car with Damage: Fees and Penalties

Even slight damage at lease return can lead to extra fees. Whether it’s cosmetic wear, mechanical issues, or overlooked maintenance, understanding the financial side can save you from a stressful surprise.

Possible Charges to Expect

Wondering what damage really costs at turn-in? Here’s what leasing companies usually charge for, and what might surprise you.

| Type of damage or issue | What’s likely to happen |

| Excessive wear and tear | Anything beyond “normal” use, like large dents, deep scratches, or upholstery tears can trigger repair charges. (“Excessive wear beyond leasing standards may result in additional repair costs.” |

| Disposition fee | Most leases include a return fee (typically $300–$500) to cover cleaning and inspection. It’s often waived if you purchase the vehicle instead. |

| Repair fees | If damage is significant, the leasing company will charge you to fix or restore the vehicle. You might also negotiate repairs beforehand. |

How It Typically Goes Down

From inspection to final bill, here’s the typical sequence of events when returning a leased vehicle with damage.

- Return inspection: Your vehicle goes through an inspection where any damage is assessed against your lease contract’s wear-and-tear standard.

- Fee assessment: If damage exceeds acceptable limits, you’re billed for repairs, plus the standard disposition fee.

- You’re charged: Lease-end costs typically include the repair fees, the disposition fee, and potentially a penalty for excessive mileage or missing maintenance.

- You can reduce charges

- Pre-inspect and document using photos and notes.

- Handle minor repairs yourself or via a trusted third party, often lower cost than dealer charges.

Got a surprise ding from a rogue shopping cart? Don’t freak out; you’re in good company. One leaser on forum said, ‘I turned in two leases I was sure would cost me… still didn’t hear a peep from the company’.

Who Pays for Damage on a Leased Car

If your leased car gets damaged, the responsibility for repairs often depends on what kind of damage it is and when it happened.

Here’s what you’re likely responsible for:

- Everyday wear and tear: Light scratches, small dings, or worn tires might be considered normal, but anything beyond your lease’s “wear-and-tear” standards could lead to extra charges at lease-end. It’s smart to get an inspection before your return date.

- Accidents or unexpected damage: If your car is involved in a collision or gets damaged from weather, vandalism, or theft, your insurance is typically on the hook. Most leases require full coverage, including liability, collision, and comprehensive, so make sure you’re protected.

- Mechanical issues from neglect: If something breaks due to missed maintenance, like skipping oil changes or ignoring warning lights, you’ll be paying out of pocket. That’s on you, even if the car is still under warranty.

Don’t forget: Make sure to remember tire checks. Autotrader flags worn tread below 1/8″ as a common inspection fail. Spending $100 on tires now beats a $500 surprise later.

Repairs covered by your car lease or warranty may include:

- Manufacturer defects or warranty repairs: If the car has a problem that’s covered under the warranty and isn’t your fault, the cost usually falls on the automaker, not you. Just make sure to take it to an authorized service center.

- Repairs from certified protection plans: If you opted into a lease protection plan when signing your lease, you might already have coverage for minor dings or certain repairs. Review your contract to know what’s included.

Pro tip: The earlier you know about damage, the more options you have. If you’re nearing lease-end and want to avoid charges, consider a pre-inspection or even a lease buyout option if your car’s market value still

Ready To Move Forward? Lease End Department Makes It Easy

Damage fees, end-of-lease charges, inspections, there’s a lot to think about when your lease is ending. But here’s the good news: you’re not stuck with just one option.

At Lease End Department, we help you take control of the lease-end process, especially if you’re dealing with damage or considering a buyout.

We guide you through the numbers, the paperwork, and the smart next step, so you don’t have to deal with dealership pressure or confusing fine print.

Here’s how we help:

- Free lease-end reviews: We break down your contract, your car’s condition, and your buyout options in plain English

- Buyout support from start to finish: If keeping your car is the right move, we’ll help you finance it and handle all the paperwork online

- No surprises, no stress: We’re upfront about your costs and next steps. You’ll never deal with hidden fees or last-minute markups

Every automaker has its own quirks when it comes to lease-end policies. If you’re driving a Kia or a Honda, we’ve put together detailed guides that break down exactly how buyouts work for each brand:

- Kia lease buyout options

- Honda lease buyout options

Thinking of buying or financing it out instead? Might not be a bad move, especially if fixing those dents sounds worse than just keeping the car. Give us a shout and we’ll give you plenty of reasons why Lease End Department is the real deal.

What Happens If You Damage a Leased Car: FAQs

What happens if you damage a leased car?

You can absolutely still return a damaged vehicle, but be prepared to pay if that damage exceeds what’s considered “normal.” Return inspections look for signs like scratches bigger than a credit card or dents that go beyond everyday use. If your vehicle doesn’t meet the standard, you’ll likely face repair charges.

What is acceptable damage on a leased car?

Minor dings, light scratches, and interior wear, like seat creases or scuff marks are usually considered normal wear and tear. But anything bigger, deeper, or more noticeable may result in a fee. Cars should be in fair, expected condition based on regular use.

Do you have to report damage to a leased car?

Yes. Especially if it’s more than a minor scratch. Quick communication with your leasing provider and your insurance can save you from bigger issues later. They’ll guide you on repair requirements, approved garages, or whether an early inspection makes sense.

What happens if you scratch a leased car?

Small scratches under a couple of inches may be overlooked, but deeper or longer scratches, especially if they peel away paint, will almost certainly be flagged. If possible, it’s cheaper to repair small ones yourself or before the return date than risk a larger charge.

Who pays for damage on a leased car?

It depends on the type of damage:

- Routine wear is covered by the lessee as part of the lease responsibility.

- Accidental or weather-related damage should go through your insurance.

- Mechanical failure might be covered by the manufacturer’s warranty if it’s not caused by neglect.

What happens when you return a leased car with damage?

You’ll go through an inspection. If the vehicle has damage beyond the normal standard, you can be charged for repairs, plus the disposition fee. That’s why scheduling a pre-inspection around 60 to 90 days before lease end gives you a head start.

What about hail damage on a leased car?

Hail damage is usually covered by insurance, with comprehensive coverage handling the cost. File early and get an approved repair, or it could be counted as excessive wear and add charges. Acting promptly helps you avoid surprises later.