Understanding Lease Buyout: Key Points

- A lease buyout lets you purchase your leased car at the end or during the lease term based on the residual value listed in your lease contract

- This can be a smart move if your car is worth more than the buyout price, if you’ve taken good care of it, or if you want to avoid fees for wear, tear, or excess mileage

- There are two types of lease buyouts: end-of-term and early buyout, each with different financial implications

- Lease End Department helps you with the entire buyout process, offering pre-approval, financing help, and document handling

Did you know nearly one in five leased vehicles is bought out by the driver at lease-end?

With used car prices still above pre-pandemic levels and new inventory limited, more drivers are choosing to keep the cars they already know and trust.

In this guide, you’ll learn:

- What a lease buyout means and how it works

- The difference between early and end-of-term buyouts

- When a buyout is financially worth it

- How to compare rates and calculate your cost

- How Lease End Department helps you finance and finalize the buyout with ease

How Does a Lease Buyout Work

A lease buyout lets you purchase your leased car instead of returning it, often at a price set when you first signed the lease. It can be a smart, budget-friendly move if your car still fits your needs.

Understand Your Residual Value and Payoff Amount

Every lease includes a residual value, which is the pre-agreed price you can pay to buy your car at the end of the term.

For example, if your car had an MSRP of $30,000 and a 50% residual, your buyout price would be $15,000.

However, your payoff amount might be slightly higher if you buy out early.

It can include:

- The residual value

- Remaining monthly lease payments

- Applicable taxes

- Lease-end fees or early buyout charges

Let’s say your residual is $17,000 and you have three payments left at $400 each. Your estimated payoff would be $17,000 + $1,200 = $18,200, plus tax and fees.

Steps To Complete a Lease Buyout With Your Lessor

Before starting, it’s a good idea to check if your vehicle is worth more than the payoff amount. Use tools like Edmunds, Kelley Blue Book, or Carvana to assess current market value.

Here’s how the process usually works:

- Get your payoff quote from the leasing company or lender

- Compare the payoff to your car’s current market value to ensure it makes financial sense

- Apply for a lease buyout loan if you’re not paying in cash

- Sign the necessary documents, which may be done online or by mail

Handle tax, title, and registration through your lender, the DMV, or Lease End Department if you’re using a service.

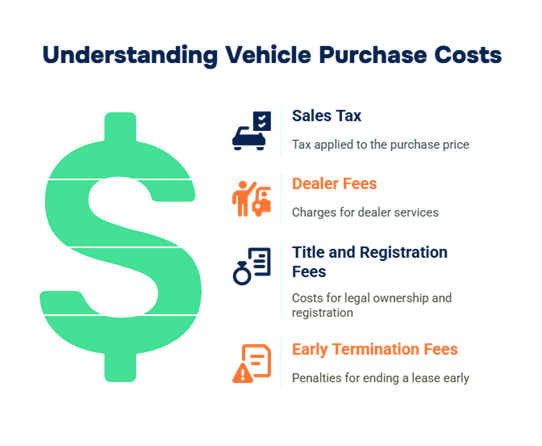

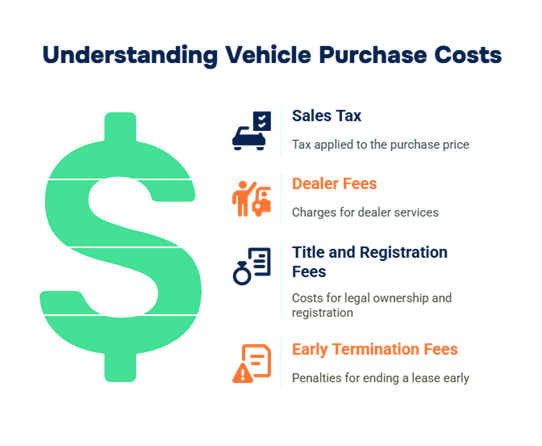

Typical Fees and Taxes to Expect

You’ll need to plan for:

- Sales tax, which varies by state (e.g., 6.25% in Texas or 7% in NJ)

- Title and registration fees, often around $100 to $300

- Dealer documentation or service fees, which can range from $200 to $700

- Early termination fees, if buying out before lease-end (check your contract)

Example: If your payoff is $18,000 and your state tax rate is 6.5%, you’d pay about $1,170 in tax, making your total closer to $19,170 before any financing charges

Types of Lease Buyouts

There are two main types of lease buyouts: end-of-lease buyouts and early lease buyouts.

1. End-of-Lease Buyout

An end-of-lease buyout occurs when you purchase the vehicle at the conclusion of your lease term. The price is typically the residual value listed in your original contract.

Why choose this option:

- You love the car and want to keep it

- The vehicle has held its value well and is worth more than the residual

- You want to avoid wear-and-tear or excess mileage fees

Example: You leased a vehicle with a residual value of $16,000. At lease-end, similar used models are selling for $18,500. Buying out the lease could save you $2,500 compared to buying another used car at retail.

2. Early Lease Buyout

This can be beneficial if your vehicle is worth more than the payoff or if you need to get out of your lease early for personal or financial reasons.

When it makes sense:

- You plan to keep the vehicle long term

- You’re relocating or downsizing and want to sell the car after buying it

- Your car’s current value exceeds the payoff amount

Example: You still have 10 months left on your lease, but your car is worth $22,000 and your payoff is $19,000. Buying it out now and reselling could yield a $3,000 equity gain, especially in a strong used car market.

When Does a Lease Buyout Makes Sense?

A lease buyout can be a smart financial move, but only in the right circumstances.

Below are some of the most common situations when buying out your lease could benefit you.

You Love the Car and Want To Keep it

If you’re happy with the car’s performance, condition, and features, a buyout lets you skip the hassle of shopping for a new vehicle.

Example: You’ve maintained the car well, it still fits your needs, and you prefer not to take on a new lease or loan. Buying it out gives you long-term value without starting over.

Your Car’s Market Value is Higher Than the Residual

Check your payoff amount and compare it to the car’s current value on sites like Kelley Blue Book or Edmunds. If the market value is higher, you may have built equity.

Example: Your lease’s residual value is $15,500, but similar cars are selling for $18,000. That $2,500 in equity could be yours if you buy out and resell, or just keep a car that’s a good deal.

You Want To Avoid Mileage or Wear-and-Tear Penalties

If you’re well over your mileage limit or have minor cosmetic damage, buying out the car could help you avoid return fees.

Example: Returning your lease would cost $1,200 in mileage and damage fees. Buying the car gives you ownership and avoids those charges entirely.

You Want To Use the Car for Longer or Refinance it

A lease buyout can give you payment flexibility. You can refinance the amount or pay in full, depending on your budget and financing terms.

Tip: Use a lease buyout loan calculator to compare your monthly payments with a new car loan or lease.

What Is a Lease Buyout? Key Takeaways

- A lease buyout gives you the option to own your leased vehicle instead of turning it in.

- The right time to buy out a lease is when the market value of the car is higher than the residual value or when you want to avoid return penalties.

- Compare your lease payoff quote with current market prices to see if a buyout makes financial sense.

- Getting pre-approved for a buyout loan can help you lock in better rates and avoid dealer markups.

- Lease End Department helps you complete the buyout process with ease, from payoff estimate to title transfer.

How Lease End Department Simplifies the Lease Buyout Process

If you’re thinking about buying out your lease, Lease End Department makes the transition from leasing to ownership smooth, fast, and stress-free.

If you ride with us, you’ll get:

- Personalized buyout support: Just tell them about your vehicle and lease terms. Their team helps you understand your payoff amount and buyout options.

- Loan pre-approval and financing: Lease End Department helps you get pre-approved and compare competitive lease buyout loan rates from trusted lenders.

- No dealership visits: Everything is handled online or over the phone, including paperwork, title transfer, and registration, so you can skip the showroom hassle.

- Delivered to your door: You sign the documents, and they handle the rest, including mailing your new license plates if needed.

We’ll help you avoid hidden fees and dealership markups, which can save you thousands during the buyout process.