Understanding Residual Value on a Lease:

- Residual value is the estimated worth of your car at the end of your lease, and it directly determines your monthly payments and buyout price

- A car with a 50% residual on a $40,000 MSRP means you’re financing the $20,000 in depreciation

- Luxury cars usually have lower residual values (as low as 45%), resulting in higher monthly payments, but sometimes better buyout opportunities

- Higher residual value = lower lease payments, because you’re only paying for the portion of the car’s value you use during the lease

- A lease buyout is based on the residual value, which means the lower it is, the more likely you’ll have equity at lease-end

- You can’t negotiate residual value after signing, but understanding how it’s set can help you pick the right lease from the start

Residual value might sound like a back-of-the-contract number, but it’s one of the most important figures in your lease.

Most 36-month leases in 2025 carry residual values between 45% and 60% of MSRP, leaving you responsible for depreciation costs on half or more of your car’s original price.

But here’s the big question: Is your residual value working for or against you?

In this guide, you’ll learn:

- What residual value means and how it’s calculated

- Why it drives your lease payments and buyout quote

- What to do if your car’s market value is higher than your residual

- Whether a lease buyout is worth it based on your numbers

- How Lease End Department helps you make the right move

What Does Residual Value Mean on a Car Lease

Residual value is what your leasing company predicts your car will be worth at the end of the lease.

It’s set when you sign the contract and used to calculate your monthly payment and buyout price.

Let’s break it down:

- You’re not paying for the full value of the car, just the portion you use while leasing it

- The difference between the car’s original price (MSRP) and its residual value is what determines your depreciation cost

- The higher the residual value, the lower your lease payment tends to be

Example: Say you’re leasing a $30,000 Toyota RAV4. If your contract shows a 55% residual, it means your lender expects it’ll still be worth $16,500 when the lease wraps up.

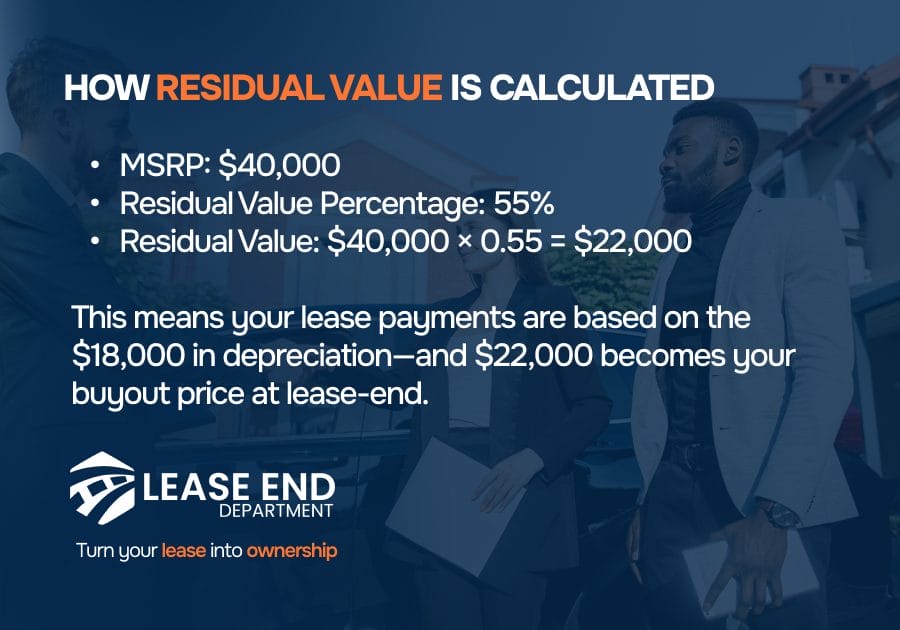

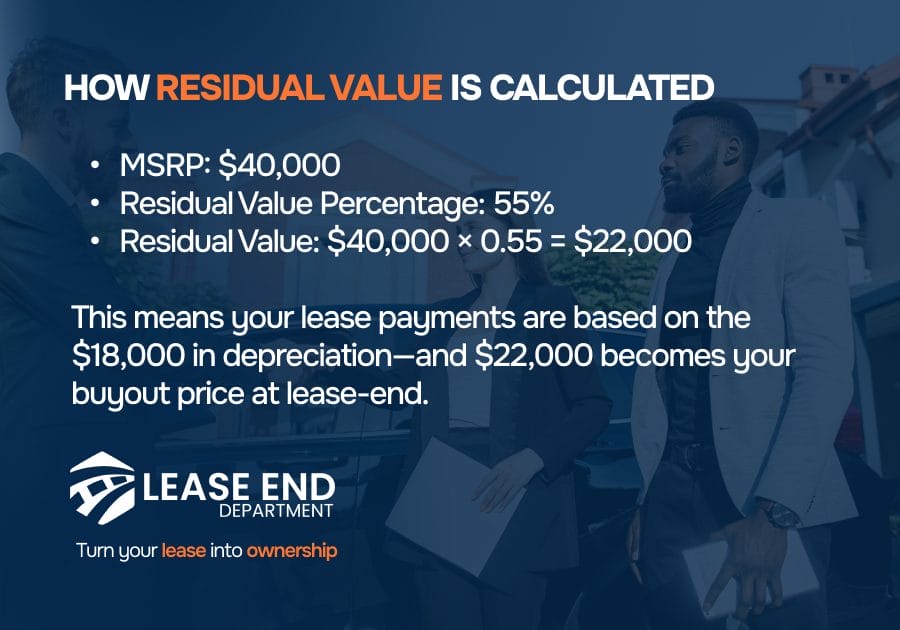

How To Calculate Residual Value

There’s nothing random about your lease’s residual value; it’s based on data and projections, specifically, how much your car is expected to be worth when the lease ends.

- Residual value is usually a percentage of the car’s MSRP (Manufacturer’s Suggested Retail Price).

- Most residual values range from 45% to 65%, depending on the make, model, and lease term.

Formula: MSRP × Residual Percentage = Residual Value

Example: If a car has an MSRP of $35,000 and a residual value of 60%, the residual value is $21,000. That’s what you’d pay if you bought the car at lease-end.

Who Sets Residual Value for a Car Lease

- Leasing companies and banks set the residual value using industry data, resale trends, and third-party analytics

- Many rely on guides like ALG (Automotive Lease Guide), which projects resale values based on real-world depreciation patterns

- The residual value is locked in when you sign the lease, it doesn’t change during your term

Pro tip: Some brands intentionally offer high residuals to make lease payments look lower. That’s great for monthly affordability but may not always be ideal if you plan to buy the car at the end.

How Residual Value Affects Your Lease Payments

Residual value plays a major role in how much you pay each month for your lease. The higher it is, the less you pay to drive the car during your lease term.

Monthly Lease Payments Are Based on Depreciation

When you lease, you’re essentially paying for how much value the car loses, not the full cost of the car.

Formula: MSRP – Residual Value = Depreciation (what you’re financing)

Example:

- MSRP: $30,000

- Residual Value (55%): $16,500

- You’re paying for the $13,500 in depreciation (plus interest and fees)

The more value your car retains, the less you’re responsible for, which means lower monthly payments.

High Residual = Lower Payment, but Less Room for Equity

- Good for budgeting: That high residual might look great on paper, but it doesn’t always mean you’re getting the best long-term deal, especially if you plan to buy

- Not ideal for buyouts: If the car holds value well but the residual is also high, you may not have much equity at lease-end

Low Residual = Higher Payment, but Better Buyout Opportunity

- You’ll pay more monthly but may end up with a lower buyout price if you plan to keep the car

- More likely to have equity if the car’s market value is higher than its residual

Why Residual Value Matters at Lease End

When your lease is almost up, the residual value becomes more than just a number; it’s the price you’ll pay if you decide to keep the car.

Since residual value is locked in when you sign the lease, it can either work in your favor or cost you more depending on current market conditions.

Here’s why it matters:

- It’s your buyout price: If your residual value is $17,500, that’s what you’ll pay to purchase the car, before taxes and fees

- You might have equity: If your car’s market value is $20,000 and your residual is $17,500, you’re sitting on $2,500 in equity

- It helps you decide: Knowing the residual helps you weigh leasing vs. buyout. If your car is worth more than the residual, buying it could be a smart financial move

- It affects your negotiation leverage: Even though the residual usually isn’t negotiable, it can help you compare dealer offers and third-party quotes objectively

Pro tip: Use tools like Kelley Blue Book, Edmunds, or Carvana to check your car’s current market value 30–60 days before lease-end. If it’s higher than your residual value, a buyout might be your best option.

How Lease End Department Helps You Make the Most of Your Residual Value

Understanding your lease’s residual value isn’t just about math; it’s about knowing your options.

At Lease End Department, we help you decode what your residual value really means so you can make the smartest move when your lease ends.

Whether you’re considering a buyout or comparing your car’s market value, we make the process simple and stress-free.

Here’s how we support your next step:

- Clear lease-end analysis: We review your residual value, payoff amount, and real-time vehicle value, so you see the full picture.

- Fast buyout support: Want to keep your car? We help you finance your buyout, handle the paperwork, explore loan rates and even deliver your plates.

- 100% online process: No dealerships. No pressure. Just straightforward answers and help when you need it.

- Why Lease End Department? Because we believe the end of your lease should be the start of a smart decision, not a guessing game.

What Is Lease Residual Value: FAQs

Got additional questions about residual value? Here are the answers that matter most when it comes to lease payments, buyouts, and making smart lease-end decisions.

What is residual value on a lease?

Residual value is the estimated worth of your leased vehicle at the end of the lease term. It’s pre-set in your contract and determines your monthly payments and lease buyout price.

What is the residual value of a leased vehicle used for?

It’s used to calculate your monthly payments and the amount you’d pay if you decide to buy the car at lease-end. The higher the residual, the lower your monthly payment.

How do I calculate the residual value of my car lease?

To calculate your car lease, multiply the MSRP by the residual percentage listed in your lease agreement.

Example: $30,000 car × 55% = $16,500 residual value.

What does residual value mean on a lease if I want to buy the car?

It’s your base buyout price, what you’ll need to pay (plus taxes and fees) to keep the vehicle after your lease ends.

What is a good residual value on a lease?

Generally, a residual value of 45% to 60% is considered strong. Higher values mean lower payments, but potentially less equity if you plan to buy the car.

Can you negotiate residual value on a lease?

No, residual values are set by the leasing company and based on industry projections. However, some dealers may offer incentives or waive fees at lease-end.

Is there a residual value calculator for cars?

Yes. Tools like Kelley Blue Book, Edmunds, and Carvana can help you estimate your car’s current value and compare it to your lease’s residual amount.